What the fuck to do now?

The same keep stacking good assets and think bigger.

This is not financial advice. This is me journaling. I’m just a guy on the internet.

It is very hard to be disciplined. Now, especially when even dinosaur companies like Nokia go up 65% in a month. As a Finn, I have followed this company my entire life. From world domination to near death to... whatever this is. When Nokia is pumping, you know we’re in the “everyone’s a genius” phase of the cycle.

Keep your head cool, but don’t let it freeze.

Sometimes the best play is just to do nothing! Currently, I just play around with different scenarios, less social media, less news, read more, and think more.

The AI clown rally was spot on:

The conviction was not there; I knew that the clown rally would come, and what assets would rally the hardest. It was challenging in late 2022 and early 2023 to imagine that Nvidia would become a $ 5 trillion company. Well, 10 trillion does not look so ridiculous now.

Go with the flow, be a clown. Everybody knows it is a bubble, even Sam Altman says it is a bubble, but who cares?

I like to build scenarios in my head like this: “Clown rally from AI hype.” Now I have to start wondering where the top is and what is the perfect setup is to slay the sheep.

The setup:

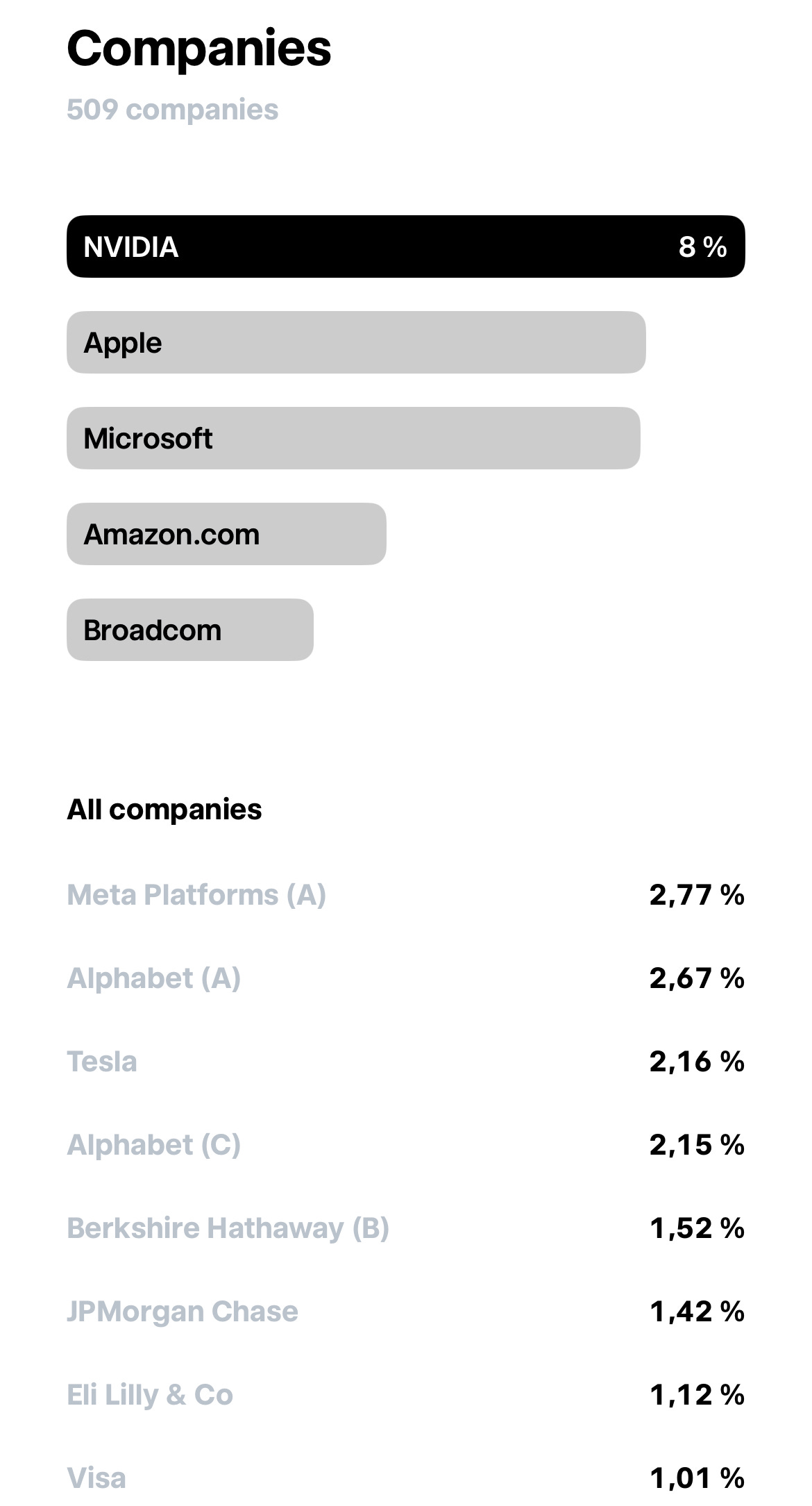

Concentration.

NVIDIA is almost 10% of the S&P 500

The top 5 companies are 28%

Passive investing.

These are really cool. I have accounts at almost all the platforms, and these are nice because you automatically invest in low-cost ETFs.

→ No risk management. Passive investing on autopilot: “Just DCA into SPY and retire in 10 years, bro”

Social media screams that passive investing in the S&P 500 is bulletproof. (Yes in the long… People will panic, though, eventually.)

Everyone’s a genius in a bull market

The bears will be humbled again. Markets don’t crash when everyone expects it - that’s why 2023 rallied, despite doomers predicting an apocalypse. The market ≠ the economy. Crashes need panic, liquidity crisis, or earnings collapse.

Burry’s shorting NVIDIA and Palantir now. X is screaming “Big Short 2.0!” But remember: he went “Big Short” in 2005 and waited three years bleeding capital.

There’s minimal EV+ in gambling here. Time to read, think, live frugally, and position for what comes after the music stops. The clowns always get slaughtered last.

AI

Well, well, everybody gets humbled eventually. Whether in the market or in life, you will be humbled.

What a douchebag.

Latest crying that they need government-backed loans… Too big to fail?

What i know about AI.

AI deflates everything except the energy bill. Energy is all that matters.

The biggest clowns

Finnish hospital can’t afford free coffee for volunteers. No Mother’s Day cake budget for grannies. But somehow we find billions for weapons to Ukraine. The saddest part? Finns still believe these clowns. Four years of being wrong about everything, but politicians never admit mistakes: they double down and call you a “Russian bot” for noticing.

The COVID playbook recycled: Fear, warmongering, “we need 5% GDP for defense!” Against what? Russia that’s supposedly collapsing in two weeks? Or Russia that’s taking over the world? Pick a narrative. Don’t dare use common sense in Europe, that’s “Russian propaganda” now.

Russia is a shithole, sure. But Europe is speedrunning to become an even bigger one. We’re destroying wealth and common sense with virtue-signaling policies while our hospitals can’t afford coffee. Wasn’t on my bingo card that Europe would out-shithole Russia through pure bureaucratic incompetence.

War has always been the state’s favorite tool to exploit the productive classes. Same playbook, different century.

Will Europeans ever find their balls? Or just keep voting for more of the same while wondering why everything gets worse?

Bitcoin:

Good read:

The phygolocigal price target for many of the OG Bitcoiners is this 100k. The market was not even mature enough to make an exit, now casually swapping to $ 9 billion? (Galaxy sale) Price staying boringly around 100k? Yeah this grind in 100k has lasted long and might continue. Will the Bitcoin price go under 100k if there is a stock market crash? Well yeah, but -80% from here? I still keep stacking, this is the most undervalued asset out there. Everybody is so bearish for Bitcoin, so big surprise in 2026? Well, I will hold this fucker +10y.

I see it more and more, people adopting frugality while paradoxically gambling on stocks, they don’t get it yet. Forced into the S&P 500 casino because our money is debasing.

Meanwhile, Bitcoin sits there as the ultimate savings account, the simplest idea: money that can’t be printed. Focus on your craft, raise good kids, save your sats, and ignore the noise. It used to be that simple (gold coins). Why can’t it be again? The simplest idea is usually the best investment. The simplest idea is usually the best savings strategy.

Yet here we are with “Bitcoiners” crying that the price is only $100,000 per coin. Ridiculous.

“Show me someone who holds Bitcoin and is happy. In a bear market and happy. During a crash and happy. While everyone calls them foolish and happy. Show me! You want to see a true Bitcoiner? But since you can’t show me someone that perfectly formed, at least show me someone actively forming themselves so – someone stacking sats regardless of price, building regardless of sentiment. Instead I see “Bitcoiners” checking charts every hour, crying about not having enough, gambling with leverage. Show me the real ones.”

Adapted from Epictetus, Discourses, Book II

True Bitcoiners serve mankind by fixing the money, the exact opposite of cash flow maximizers extracting their pound of flesh. Value investors worship at the altar of cash flow, analyzing “moats” while ignoring the societal rot their companies profit from (the majority of businesses nowadays). They dismiss Bitcoin for having no cash flow, completely missing the point. Bitcoin’s value isn’t in extracting rent from society, it’s in giving society incorruptible money. That’s the service. That’s the mission.

Fix the money, fix the world.

Commodities and hard assets, etc.

Monetary reset eras make hard assets the stars (1970s).

Are stablecoins a monetary reset? No. They are just an extension of the dollar. As an Eurocuck, I welcome these; they are a gateway out if the EU goes deeper into even more socialist policies (Bitcoin is the best).

These are still pro-centralization tools. Governments will control the onramp and offramp 100%. Degens can still be degens in their sandbox…

It’s a weapon to make the dollar even more dominant, not a revolution.

Why bet on commodities and hard assets?

Financial assets continue to perform very well. Stablecoins thrive under new regulation.

→ More dollars. Financial assets win. Commodities & Bitcoin do well.

China? Russia? EU? Competing settlement blocks emerge, increasing the risk of the next reset.

→ Financial assets suffer. Commodities & Bitcoin win.

Financial repression and debasement continue.

→ All assets rise, but people lose even more. Commodities & Bitcoin win.

Uranium & Nuclear Power.

Europe was halfway there in the 70s-80s with the solution: nuclear power. Then we got scared and stupid. Now we’re trying to run datacenters on wind and prayers. You can’t decarbonize AND maintain 24/7 power without nuclear

Common sense always wins in the end. Don't lose hope; the same will happen here. (Yes, it can take a very long time)

→ Uranium should be a good bet. (Has already had a pretty good run, but can run even more.)

OIL/Energy

We keep dreaming, and we should dream, but one fact is also thatt go away. I’t go away. I would argue that with all the AI etc “green transition” we need oil, gas ENERGY more than ever.

I know literally nothing about this industry.

Oil and gas are the most hated asset class right now, which is exactly why I’m buying. Small bet, long horizon: Xtrackers MSCI World Energy. Set it and forget it for 5+ years.

Good companies

Never bad to own pieces of excellent businesses that will thrive regardless of which monetary experiment we’re running. The simplest is usually the best, own quality and let time work.

Sources:

https://www.tftc.io/bitcoin-third-path/