Hysteria and Tariffs

Look at trade imbalances, panic selling, and how smart investors can navigate government intervention while the masses follow algorithms to the slaughterhouse

Why invest? To make yourself immune to government idiocy, or to worship a system that doesn't care about you? I find it fascinating how system-worshippers remain clueless, then cry when things don't go their way.

President Trump announced tariffs, and everybody is panic-selling. Selling leads to more selling. But let's be honest about what's happening here.

Was the market not already overvalued at Shiller P/E 35?

Lower prices are better for long-term savers. AMD was one of the hottest AI plays at +200. But at 85, it is garbage.

People are so emotional nowadays.

First, they FOMO, then they panic and act stupidly. Buy high, sell low.

The views on tariffs have been incredibly idiotic. I have not seen any good ones on this (few in the sources).

Let’s throw shit to the wall:

It is all about major trade imbalances.

Trump said he would announce tariffs.

Trump likes to make deals.

Win win deals or Lose lose deals? More of win-win deals. Pro-business?

The USA will be a net loser in all this, but the surplus countries will lose even more.

The reset is long overdue. The last time was the 1985 Plaza Accord.

Plaza Accord 2.0?

The USA is the world's biggest consumer. It runs a massive deficit, eating all the overproduction from the rest of the world. But let's be clear - surplus countries didn't force America to take on debt. The USA chose this path.

U.S.A Deficit: Buys more than it sells, loves imported goods, spends a lot, strong dollar.

Surplus Countries: Sell cheap-made goods globally, focus on exports, weak currency, attract factories.

Which countries lose the most in this trade war? Countries that run surpluses. Countries that support their production too much.

Are tariffs the best policies on this? No. Tariffs are idiotic. ALL FUCKING GOVERNMENT INTERVENTION IS IDIOTIC. Again, I'm not here to cry or whine about how idiotic the government or the suits are. The whole point from the beginning has been and will be to make oneself immune to this idiocy.

Tariffs are populist policies that raise the standard of living of the masses. This will make Americans, Japanese, Europeans, Chinese, and everybody in the world poorer on average. Production and employment patterns will be rearranged. Labor is less productive everywhere in the world. Consumers pay higher prices because of the tariffs (1)

Small business perspective and Finland.

Finland is a huge benefactor of trade with the United States, often enjoying a net gain (trade surplus) in the billions of euros each year (6-7bn).

We had COVID, war, and then loss of purchasing power and recession. Now, global trade war? It is tough to navigate. What do entrepreneurs hate the most? Extreme uncertainty. In Finland, we have had zero growth for the last 20 years; if this trade war escalates to extremes, it will be gruesome. EU/Finland has no leverage, and the only option is to bend the knee and make deals. The whole of Europe has rotten leadership. Are they willing to lose their pride and bend the knee for Trump? Make the deal fast! Supply-chain shocks, diminished demand, and potential losses… Small businesses in Finland won’t survive unpredictability very long.

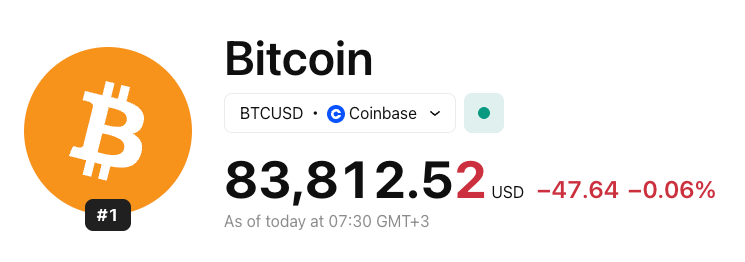

We are witnessing the birth of a global safe-haven asset. Bitcoin is immune to tariffs. Adopt the Bitcoin standard and promote freedom. Bitcoin’s neutrality offers a hedge against inflation and other policy errors. Honestly, I am also surprised it has held so well during this turmoil. Well, frankly, most of the time, it has shown initial strength, but then it went to the toilet with other assets. This time, it is different. (And yes, it is down -25% from the ATH of 108k)

For me, the biggest question is, will the financial repression accelerate in Europe?

I started this little adventure to write and blog; it is mainly for my amusement to cringe at my old posts and vent to the internet. Even though 99% I say is total bullshit, this is a good exercise to be prepared and maintain mental clarity. My first post is still relevant because I was lucky enough to stumble on Russel Napier's interviews. M. Pettis is always helpful in trade and China. Financial assets might not be the place to be next decade; this is a kind reminder.

Like a modern samurai, you must be prepared and know your enemy. You must study the system's patterns while remaining detached from its emotional pull. Understanding how markets move, how governments intervene, and how the masses react gives you the edge when others are blinded by panic or greed. This isn't about predicting the future - it's about being mentally equipped to navigate whatever comes.

We are constantly bombarded by news and events, and it is almost impossible to keep up. Last week was something monumental and now it is the tariffs and why bomb some huthis too. Let's say everybody is a terrorist, so the bombings are just fine.

Use common sense.

Less news and X, 5 min is enough, and there is no value in spending more time.

Read books and learn more.

Spend time with family.

DCA to Bitcoin and other good assets.

Live three levels below your means.

Start obtaining residence permits…

Critical thinking is key; nowadays, getting ahead does not take much since 95% follow the algorithm.

Outwork, then out-wait.

Sources and good reads:

Good teenager analogy:

https://x.com/saifedean/status/1908387127907254373

(1) Choice: Cooperation, Enterprise, and Human Action Paperback – 1 Jun. 2015 English edition by Robert P. Murphy Link: Amazon This is an excellent book.

https://www.tftc.io/gold-scott-bessent-tariffs/

https://rumble.com/v6rnv2x-system-update-show-434.html