Currency wars 2.0

The race who can debase the fastest

We have been in silent depression since 2008 (Kalinowski). I just ask you to look around. Here in Finland, our government lectures us to shit in a bag in case of a rolling blackout. We have also been in “currency wars” since 2008. Oh, how much food do you get now with 100€? A lot less than we used to a few years ago… We in the western world don’t pay much attention to currencies. We aren’t used to thinking that, and we are programmed to consume everything.

The term "currency war" was first coined in 2010 by Brazilian finance minister Guido Mantega, who used it to describe a situation in which countries were intentionally weakening their currencies in order to gain a competitive advantage. The primary focus was back then on China and its unfair advantage of a tightly controlled Renminbi. China’s extraordinary growth was based on exporting cheap goods to western countries. Even back then, there were plenty of anecdotal stories about China’s real estate market. Couples “divorcing” just to be able to take out more mortgages to lever up and buy more houses, and plenty of “ghost cities” formed even 12 years ago. How’s China looking now? We are witnessing the birth of a totally controlled currency. Freedom and privacy? It is hard to see that the Renminbi will become a serious competitor to the dollar since China’s policies should change radically to be more open (Pettis). Where will we head next?

Beggar thy neighbour - Brief history of currency developments

Great depression 1930’s

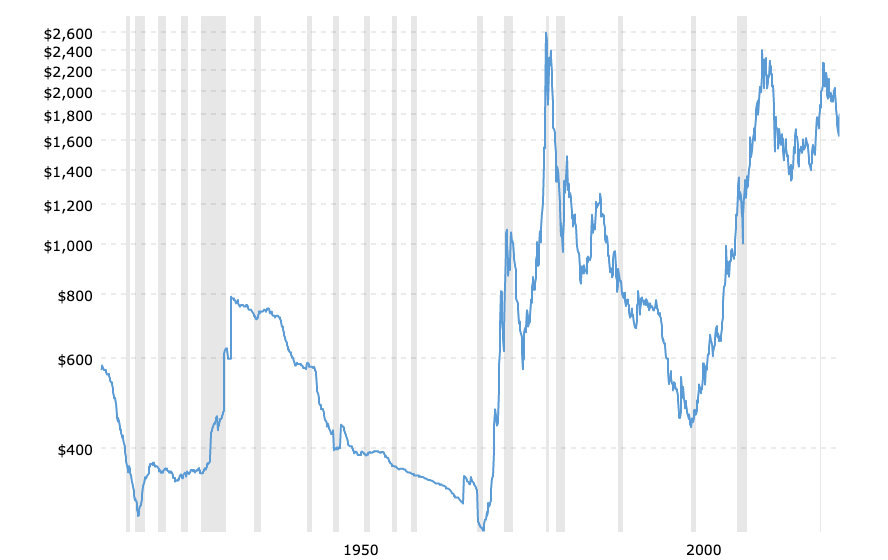

Currency wars are nothing new, and many countries adopted policies of competitive devaluation in an effort to stimulate their economies during the Great Depression. This led to a sharp decline in international trade and ultimately contributed to the severity of the economic downturn.

Massive debt and breaking of the gold standard = Trust was lost.

→ Stocks and Bonds are both down.

→ Gold was “banned” and confiscated by governments in 1933.

The great depression ended after ww2.

Gold standard 1944

After World War II, many countries sought to create a more stable global economic system, and the Bretton Woods agreement was reached in 1944. This established the gold standard, under which countries pegged the value of their currencies to the price of gold, and the US dollar became the world's reserve currency. A rules-based system, awesome?

Again the greed and lure for “easy money” won, and Gold pegs started to tumble, London's gold pool collapsed in 1968, and everybody devalued currencies (Lewis).

—> A Rules-based system to promote stability and prevent countries from devaluing currencies —> Implement clown policies to run deficits —> Inflation —> Raise interest rates —> Weak clowns tumble and ultimate collapse of Bretton woods system in 1971.

→ Stocks and Bonds are both down 1969.

→ Massive deficits.

Gold did nothing wrong here.

Goldbugs were truly born. Fuck the clowns. I don’t believe in any “system” collapse, hyperinflation, or conspiracy theories of lizard people. I still encourage everybody to question what money is and own some gold and Bitcoin, just in case, be it for insurance? Or keep our governments at least somewhat honest.

So what now? Stocks and Bonds are both down… Record high deficits and DEBT

We were already heading into a slowdown during 2019. Covid arrived, and a massive stimulus was introduced. Hurray, we are saved! The everything bubble just got a little bit bigger. Rising interest rates in a weak economy? Shit and pure scams tumble first (crypto). I hope for some soft landing / mild recession. The world is not ending here. It will continue to do its thing. Clowns just keep rigging the game. The sad part is that we keep playing the game.

Fed keeps tightening until something breaks.

—> USA “fixed rates” mainly, but most of the rest of the world in Fluctuating rates. The dollar remains the king, the least shitty of them all.

Something breaks, and it doesn’t have to be in the USA. China? It’s not their goal to destroy the whole global financial system. Be careful what you wish for if you hope everything just blows up.

The currency wars are just starting. Huge subsidy packages and clown policies, be it helping Ukraine or supporting “green energy.” The “printing” continues, and it will only intensify from now on. Europe is desperate, and it produces nothing of value. We have an ongoing energy crisis, and we have to import commodities.

The biggest losers are people. Do we want war? Our real incomes are collapsing and will continue to do so; there is simply no other way.

This time we can’t break the gold standard, so what the fuck will the clowns do? I bet they have very high hopes of introducing CBDC (Central bank digital currencies) to us. What is certain is that the government’s role will increase from here. People will come more dependent on government subsidies. Companies. Industries. Everything. Want to have a good salary? Work for the government. Wanna start a business? Did not get subsidies? Bad luck, no winning ticket this time. The government will pick the winners and losers, not the markets. Weak economies, weak unproductive people, and weak companies begging for more tit to suck. The government will win. We are heading to financial repression (Napier).

I am super afraid that our weakness will lead to more totalitarian systems. Through CBDC, that is possible. I don’t want anybody to live under very tightly controlled currencies. I am a father of two, a dropout, and running my little service industry business. I should not have to waste time on these ramblings, but I feel I have to if there is even a slight change we end up in these dystopian CBDC. Could these CBDCs be so bad?

Iran to freeze the bank accounts of hijab refusers

Canada freezing accounts of freedom protestors…

What problem does CBDC solve? Nothing.

How to protect your time and energy?

What do governments need most at the moment for “green energy”? It will be massive amounts of fossil fuels and commodities; you simply cannot “print” energy.

Nuclear energy will be a big winner in the future. —> Uranium? Still, some common sense is left in the world.

Electric cars, battery recycling, Lithium, —> Who will become key players in eg, Europe for Lithium, etc., infrastructure? (BASF?)

Plenty of need for workers, huge margins to install solar panels, etc, tax benefits, and subsidies.

ETF’s for emerging markets? Brazil? Plenty of commodities. Norway also has everything going on that Europe needs.

Heck, all the raw materials will probably do just fine, from coffee to wood, metals etc. When our currencies are devaluing, save your time and energy in commodities. Gold will do well, too, and central banks are buying it like no tomorrow now. Read: Stability out of chaos: Benjamin Graham’s commodity reserve currency

These are not-so-viable options for us common joes, stack sauna full of sugar? Garage? Gold would be excellent too, but it is so clunky. How I transfer gold bar? Stuck in my ass and hoping security control won’t notice? Bury it to ground? How I even verify that it is real gold? Trust my paper gold that it is real? These commodity funds,etf’s, etc, also have pretty high fees, they can also require substantial deposits, these are awesome for high net-worth individuals. Wish I also had the funds to buy a big ranch with plenty of forest etc., and have that, but the sad reality is that these are not for us hard-working commoners. So how can I protect my time and energy?

Bitcoin is the strongest of them all

Bitcoin is:

First Global

Private (no government oversight)

Digital rules-based

Monetary system

Read carefully and rinse and repeat.

This is the best asset we have, like it, love it or hate it. In the long run, common sense always wins (see current developments in Nuclear energy). All other currencies are inferior VS Bitcoin. All commodities are inferior to Bitcoin. Save my time and energy in Euros for the next 5 years?

Our time preference of money is completely broken. Consume, consume and consume. Western middle-class feels “rich” when they can consume a shit ton of cheap and mostly useless toys from China.

Bitcoins monetary policy is unchangeable. Nobody can change that, ever. This makes Bitcoin the ultimate asset for storing time and energy. It is easy to swap paper for shit goods, but how about something valuable? Yes, you think twice. Start thinking in “currencies” when you consume something, be it sats, coffee beans, gold, or even stock you like. Was it worth it? Versus having some bitcoin, gold, a cabinet full of coffee, or owning a piece of some company? Our money currently doesn’t reward savings and is “free money”.

Bitcoin encourages savings VS FIAT clown paper which encourages furious overconsumption.

Why our most beautiful structures are from the gold standard era? Comparing to the present time? For eg, our newest shopping mall in Helsinki Mall of Tripla is one of the most expensive buildings in the world… Does it look like it? Does it feel like it? It looks and feels like shit, already pieces falling from it.

What about our kids? Future generations? With this shit money, we just consume everything, I encourage you to think for a second about what kind of world you want your kids to live in? Your weakness is destroying the future. We need sound money, and we need better savings solutions.

The everything bubble will explode. It will affect everything. If a recession hits, remember that everybody is starving for cash, and we will have high unemployment and, extreme stress & uncertainty. Try to get that dream real estate when you have no certainty do you even have work three months from now? Or you are already out of work, and at the same time, your savings are tanking?

Bitcoin is the best savings technology, and it’s never too late to adopt it and learn more. Cash is not such a bad option now; even though it loses purchasing power 5-15%, it’s still less than what could happen next for all assets. No need for FOMO that’s for sure. There is plenty of cleaning and destruction needed to happen in this industry. This race to debasement does not also occur overnight; slowly but surely, everything rots away. CBDCs will reinforce the clown policies, and that’s where Bitcoin will shine.

Sources & Good reads

https://www.politico.eu/article/von-der-leyen-eu-state-aid-us-inflation-reduction-act/

Kalinowski, Emil. “The Silent Depression: Trundling Is the New Booming.” CFA Institute Enterprising Investor, 11 Feb. 2020, blogs.cfainstitute.org/investor/2020/02/11/the-silent-depression-trundling-is-the-new-booming.

Pettis, Michael. “Will the Chinese Renminbi Replace the US Dollar?” Elgar Online: The Online Content Platform for Edward Elgar Publishing, 28 Oct. 2022, www.elgaronline.com/view/journals/roke/10/4/article-p499.xml.

https://www.goodreads.com/en/book/show/82107.How_you_can_Profit_from_the_coming_devaluation

https://www.forbes.com/sites/nathanlewis/2021/12/20/why-the-gold-standard-is-still-the-best-option/?sh=47de30652a8d

Lewis, Nathan. “‘Money Printing’ in the 1960s | New World Economics.” “Money Printing” in the 1960s | New World Economics, 15 Aug. 2021, newworldeconomics.com/money-printing-in-the-1960s.

Finneseth , Jordan. “Iran to Freeze the Bank Accounts of Hijab Refusers, Highlighting the Benefits of Crypto Banking.” Kitco News, 7 Dec. 2022, www.kitco.com/news/2022-12-07/No-hijab-no-banking-Iran-ups-the-ante-on-anti-hijab-protestors.html.

Dittli, Mark. “Russell Napier: The World Will Experience a Capex Boom.” The Market, 14 Oct. 2022, themarket.ch/interview/russell-napier-the-world-will-experience-a-capex-boom-ld.7606.

Sainsbury, Peter. “Stability Out of Chaos: Benjamin Graham’s Commodity Reserve Currency - Materials Risk.” Stability Out of Chaos: Benjamin Graham’s Commodity Reserve Currency - Materials Risk, 21 Mar. 2022, materials-risk.com/stability-out-of-chaos-benjamin-grahams-commodity-reserve-currency.

https://goldswitzerland.com/titanic-currency-destruction-how-central-banks-ruined-money/