Why be debt free? Do you have imagination? Can you vision better you and be excited again?

Being debt free has massive benefits. Embrace freedom.

Being debt free will help you achieve financial freedom and stability, reduce stress, and improve your overall quality of life. I know what you think now:

I know all this, and I know it better!

I know you will come up with excuses now, and you won’t continue to read further:

“Debt is actually good” “It is beneficial to have a lot of debt” “I want it all now” “All the billionaires have debt” and “I don’t want to use my brain, it is easier to consume debt”, “I love living in autopilot”. “Everybody has debt, and it is the necessary evil”.

Probably, you're not a successful entrepreneur and investor with a net worth in the tens of millions of dollars, and a team of personal lawyers and accountants at your service.

You have debt because you are lazy and uneducated.

Lack of financial education.

No discipline. Large purchase? What an impossible task to save a large amount of money.

You want to be like everybody else, have two cars, a bigger house, and better gadgets. Maintain a particular lifestyle?

Everybody has debt, so why not me too? It is impossible to start a new business or purchase a bigger house without debt! “This is how the world works!”

→ You will never achieve any financial goals with this kind of mentality.

Head over heels in debt is acceptable and even desirable today. We live in a high-time preference world. Take more debt and consume more & more. Our whole “system” promotes high consumption.

Debt's Dark Side: The Negative Consequences of having head over heels in debt.

As debt accumulates, interest payments grow, consuming more and more of your income — less money for savings and essentials.

You start to live on autopilot. Serve only the debt. You are not in control.

Stress.

Limits ability to take risks. Saw a fantastic investment opportunity? Impossible to take advantage if you have massive amounts of debt.

Hate your job, but what can you do? Have to serve debt.

Imagination slowly dies. Are you excited about having debt? You are not reading past the opening paragraph if the debt is only a tool for you and you are in control.

→ Start to take control of your finances.

What to do?

Keep it simple stupid.

Consume less or work more. Live with a student budget. Yes, it is hard. Start budgeting now.

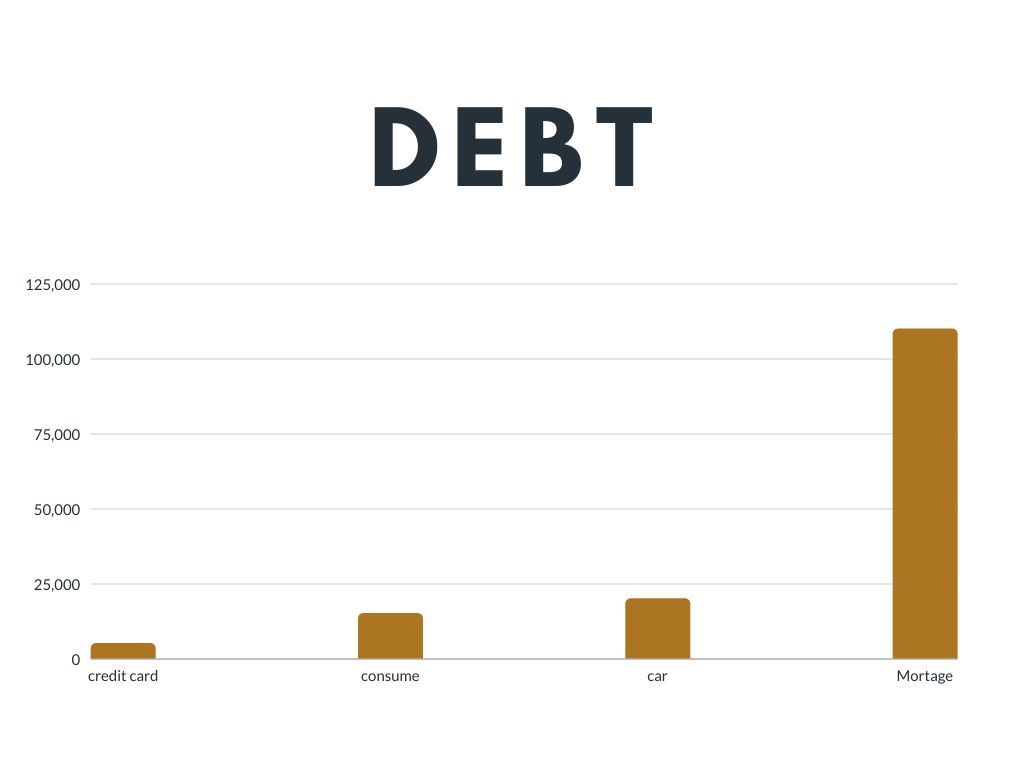

Let’s take the average Finish salary of around 3200€, and after all the taxes etc, we have 2200€ to consume: The average debt amount is around 150k. 70% Mortage and 30% rest: Car? Consumer debt?

You went on a trip to Thailand despite being unable to afford it, and on top of that, you had to renovate your bathroom and accumulate some credit card debt.

Interest rates are now on the rise, and the budget is tight.

Start visioning yourself five years from now and imagine a strong person with just a mortgage. Get excited about the idea of a new you without debt. Start treating it as a video game. Remember, it is the first time you start to attack the debt:

You start lvl 1 with a wooden sword and intelligence 7/100.

Think 6 months from now? LVL 5 with iron sword and intelligence 16/100 maybe you can do some financial jujutsu?

How bout 5 years from now, and lvl 55 and ready to attack the meanest monsters in the world? You are not scared anymore but excited, excited about the new stronger you and prepared to take over the world. You think that the game is just starting now.

Make a plan → Budget → Work more/Live like a student → Attack the debt from the smallest.

Mortgage 110k - 600€/month 4% interest rate - Can you negotiate repayment holidays etc?

Car payment 20k - 300€/month (luckily, you got that bargain at 0% interest rates, but did you have to buy a 30k car?)

Consumer debt - 15k - 200€/month - 8-9% interest rate now. That trip to Thailand is now pretty expensive…

Credit card 2k - (Interest rate 5-20%) After covid, I just had to enjoy and treat myself a little bit! 50€/month

That’s 1150€ just to service debt, and you will probably continue to live beyond your means because of the rising interest rates. Net salary little over 2k…

Ask for repayment holidays and start to attack credit card debt - Do whatever to get rid of it! Live like a student! Get rid of the highest interest-rate debt first.

Then consumer debt and maybe consider selling the car? Or could you swap it for a cheaper one?

→ Remember, getting out of debt is a long-term process that requires patience, commitment, and discipline. Stay focused on your plan and celebrate small wins along the way to stay motivated.

It will be challenging, and it takes time, but if you managed to get rid of credit card, consumer debt, and car payments, your debt servicing costs are now just mortgage 600€/month which is 550€ more money in a month to save or invest.

First, I would save 6 months of income as a safety cushion so you don’t fall into consumer/credit card debt hell again… I don’t have to ramble about what’s next. Imagine you are the hero 5 years from now, a lvl 55 with almost the best in slot equipment and intelligence 67/100. You know precisely what you need to do.

→ You have goals and vision. You have the plan.

→ You have strong values. You don’t consume just for quick dopamine. You think twice before purchasing anything. Again why am I buying this piece of shit? It does not have any value, and it does not serve any of my values.

Can you imagine and vision a stronger you?

You earn 40-50k a year and have expenses of 15k a year. You make 2,6-3,3x-year expenses. Work and invest 10 years you have +33 years of living carefree, with your lifestyle of 15k a year. Investments compounding and returning something?

I know that smirk there, “But I make more than 6 figures a year”. You also have massive amounts of debt, and you consume it almost all.

But I have a lot of stuff and a 3x bigger house and a 10x better car! Plenty of luxury items!

It may seem impossible to tackle the mountain of debt, but don't let that discourage you. Remember, every successful person has started from level 1 with just a wooden sword. Who has more wealth and better values? The answer lies within each of us, and it's up to us to choose which path to take. So start imagining a world where low-time preference is the norm and take action towards making it a reality. Debt slavery or freedom?

Or should you just focus 100% on making more money?