The Silent Revolution of Bitcoin

Kiss Goodbye to Middlemen

Put simply, value investing, at least as practiced by some of its advocates, has evolved into a religion, rather than a philosophy, viewing other ways of investing as not just misguided, but wrong and deserving of punishment. - Aswath Damodaran

I had a massive hard-on for value investing when I studied, and after my studies, I soaked all the info I could get from Buffet and Benjamin Graham and watched Damodarran lectures to death. Everything else is wrong, and “clown world”. I was part of the cult!

Yet, beneath the intricate dance of numbers, charts, and theories lies a simple, unifying truth: the ultimate goal of investing is to make money.

To truly thrive in the evolving investing landscape, we must embrace the uncertainties, broaden our definitions of value, and, most importantly, be willing to rediscover ourselves. Open your mind.

Bitcoin emerges as a beacon of mindfulness, urging investors to diversify their portfolios and perspectives.

Bitcoin is a cult, too - but it is a good one.

The illusion of safety? NVIDIA, TESLA?

Why do retail investors flock to these? Is it mania? Are they stupid? Naive? Valuations are ridiculous, and everybody looks just the P/E “What a clown world +200”. If NVIDIA grows like this, then it is cheap. Those numbers they just posted are bonkers and absolutely out of this world - deeply humbled.

Sure, these numbers mean that there will be more competition in the future and others will enter the market. Tesla is similar. Retail wants disruption and innovation; why? Seek some safety, ultimately? Hedge for inflation? Hedge for uncertainty? Megatech rules. It is already enough to try to survive the rat race 9-17, run a family, and spend 2-3 hours a day researching how to keep up and where to invest.

The march of technology remains unstoppable. The rise of AI is inevitable. So, bet on it?

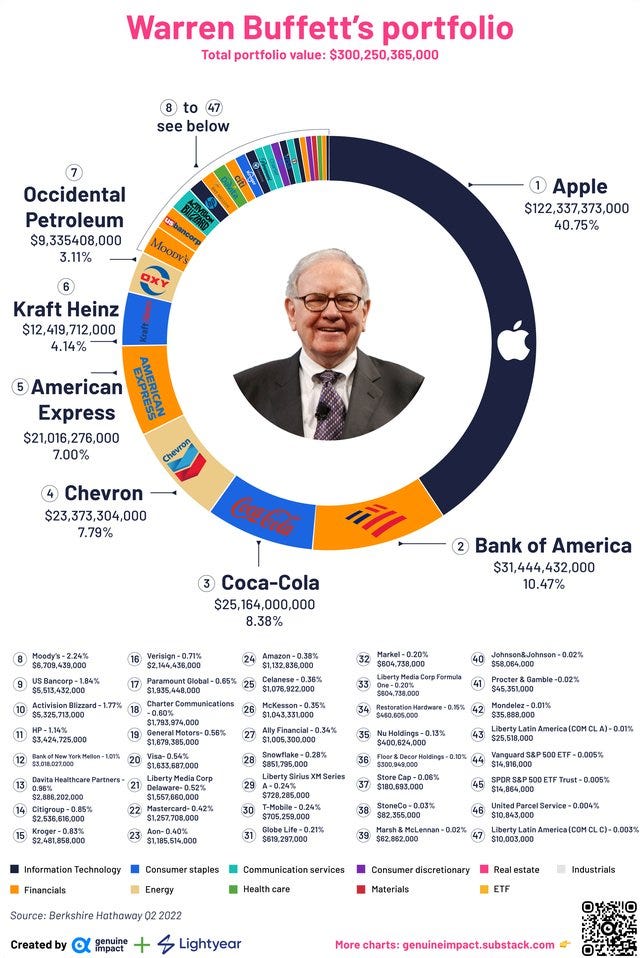

Apple: The modern-day gold?

Apple’s strengths are enormous. Brand, vast ecosystem, and new products constantly. Where else to park your money if you seek stability? Or don’t know where to park your money? Modern-day safe heaven is more secure than the vast majority of countries around the world.

Our secretary of state in Finland once said, “Apple stock is maybe a currency in the future.”

Apple is a titan of stability and unwavering expansion in an unpredictable world, outshining many nation-states. If somebody points a gun to your face, “What is the safest investment?” my first thought is Apple.

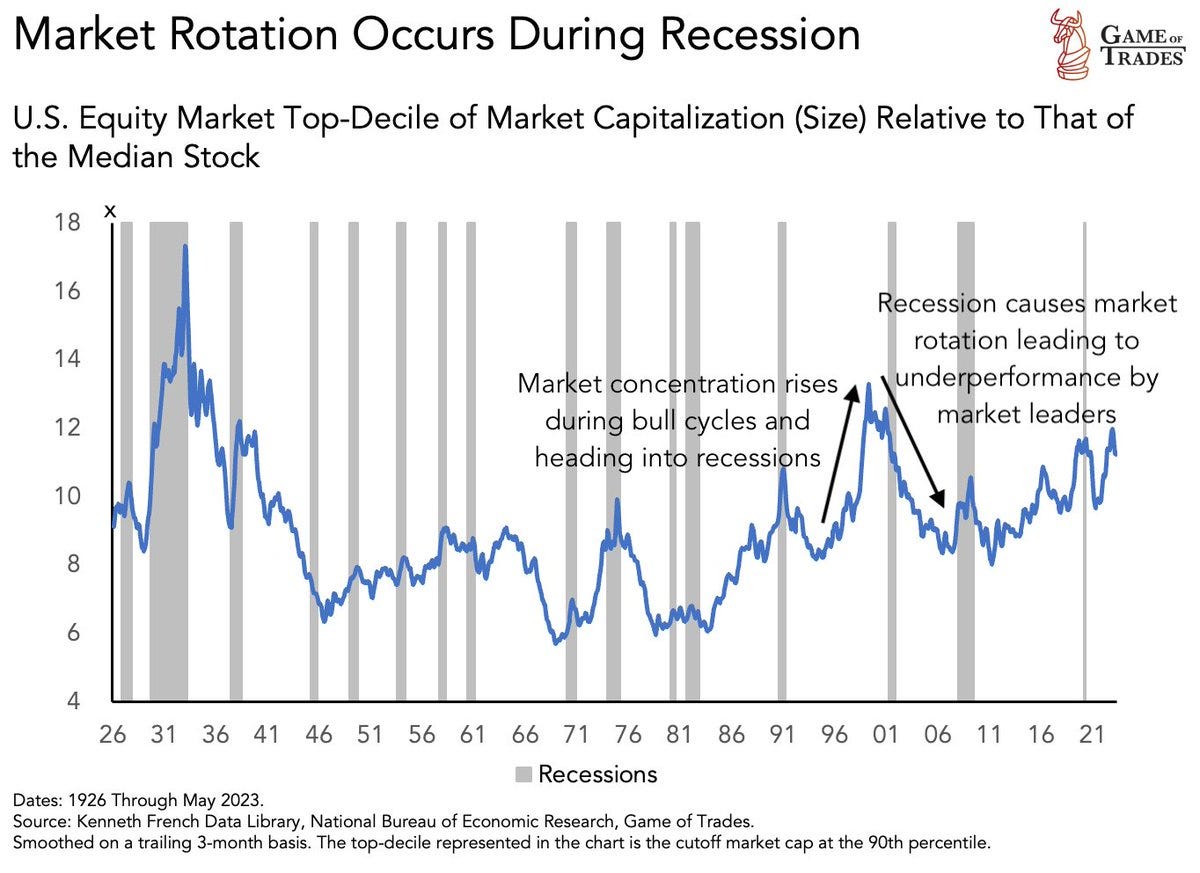

The passive investing bubble.

Everything is concentrated to the maximum. Can it concentrate even further?

The current total market cap of the whole US MARKET is 41T, and the top seven is 11T = 25%.

Well, lets pour it all into S&P500 and forget. It is Cost-Effective, Performance (Beats majority of market participants), and Simplicity.

Megatech rules.

It has 70% of other companies, too, than just the top 7. Of course, it is top-heavy, and the most substantial companies tend to win the day. Nothing new.

The Dilemma of Value Investing

In an era where asset valuations soar to unprecedented heights and time-tested metrics blur into obsolescence, the very essence of value investing stands at a crossroads. Once a beacon for investors, guiding them towards undervalued gems in a bustling market, this strategy now grapples with modern complexities. The question looms: Where does one unearth genuine intrinsic value in a market landscape that often resembles a mirage?

NVIDIA released CUDA 2007. They anticipated the rise of AI for a very long time, but the bet paid off massively in 2023… 10bn out of the 13.5bn came from the “data center” primarily driven by AI.

The digital age has ushered in disruptive technologies and business models that challenge traditional valuation methods. Companies with intangible assets, vast user bases, and potential future profits are valued in the trillions, leaving many value investors perplexed.

On top of that, we have to add the irrational behavior of retail investors, from meme stocks and SPACs, to whatever next almost-bankrupted company.

The core principles of seeking undervalued assets remain, but the lens through which we view them must be recalibrated.

Bitcoin: The Mindful Investment

What if there was something a simpler way to save money? Protect yourself from governments, inflation, and uncertainty.

Buy it at even lower fees than stocks.

Bitcoin. Yeah, it does not yield anything.

But that's not the point.

Bitcoin represents a paradigm shift in how we perceive value and store wealth. It's not just a digital currency; it's a decentralized, borderless, and censorship-resistant store of value. In a world where trust in traditional institutions is deteriorating, Bitcoin offers a transparent and immutable alternative.

Will trust in institutions increase in the future or will it continue to erode?

The Passive Investing Evolution

Passive investing, by definition, is about minimizing active decision-making. It's about buying and holding, trusting in the broader market or a particular sector to grow over time. Bitcoin, in its essence, is the epitome of this philosophy. Buy, hold, and trust in its fundamental value proposition.

When we look at the current stock market - It screams for a solution like this.

Bitcoin is not tied to any performance but is driven by scarcity and the power of a global, open financial system.

It’s better than cash (Digital gold).

It’s better than any other commodity.

It’s better than government bonds.

It is disrupting traditional stores of value Gold and Real Estate, currently capturing 3% of gold’s market cap. What do you think is it undervalued or overvalued? Will millennials horde real estate and gold in the future? Or Bitcoin?

Megatech rules the world at the moment. Will it continue to do so in the future? Will they hold deteriorating currencies in their balance sheet? Buy their stock? Buy Apple stock?

After all, in an era where innovation is currency, why would they anchor themselves to the past when they can invest in the future?

In an age where innovation defines wealth, why would megatechs cling to fading currencies when the future spells Bitcoin? Tesla already has small bags of Bitcoin. Blackrock started to hoard Bitcoin miners and will soon launch its own ETF.

As tech reigns supreme, it's not just probable but inevitable that assets like Bitcoin will eclipse traditional holdings. Don't get left in the analog age.

Bitcoin vs. Traditional Stocks

When comparing Bitcoin to traditional stocks, one must consider the fundamental differences:

Decentralization: Bitcoin operates on a decentralized network, meaning no single entity controls it. There is no CEO to fuck up shit or owners. The biggest enemy of Megatech is its owner, Elon Musk. Is he just crazy or a messiah? Was Mark Zuckerberg's VR bet good?

Scarcity: There will only ever be 21 million Bitcoins. This built-in scarcity is a hedge against inflation and devaluation, something stocks can't inherently promise. Try to bet your next “Nvidia” and face massive dilution and compensation schemes…

Accessibility: Bitcoin can be accessed and owned by anyone with an internet connection, breaking down barriers in traditional stock markets.

Innovation and Disruption: Bitcoin represents a fundamental shift in how we perceive money and value transfer. While there are innovative companies in the stock market, few can claim to redefine an entire system the way Bitcoin challenges traditional finance.

Volatility and Stability: While Bitcoin has shown significant price volatility, it's not tied to corporate earnings, quarterly reports, or geopolitical events in the same way stocks are. This can be both an advantage and a disadvantage. Understand the asset, and you welcome it. It won’t be so volatile forever.

YIELD: There is no yield like dividends on Bitcoin, just appreciation.

Liquidity: Bitcoin can be traded 24/7, How soothing is it to have world’s best assets in your pocket anywhere & everywhere? The peace of mind it brings alone is worth it.

Adoption Curve: Bitcoin is still in its infancy, with potential for significant growth as more institutions and individuals recognize its value. Stocks, while they can offer growth, don't have the same "early adopter" potential as Bitcoin. Remember, institutional adoption happens only once…

There is no competition: There is no second-best digital asset. Would you prefer some META-coin (they tried this), or Amazon coin? Cmoon, for fuck sake.

Transparency and Immutability: Bitcoin's blockchain provides a transparent and immutable record of all transactions. This level of transparency is unparalleled in the stock market or, for example, Gold markets.

Tech: Holding Bitcoin is a testament to being "ultra-bullish" on the future of tech itself. It's the ultimate vote of confidence in the tech-driven future. Why would an ultra-efficient, borderless, and logical entity like AI ever opt for a fiat currency bogged down by bureaucracy, geopolitical influences, and inefficiencies? It wouldn't. Being long on Bitcoin isn't just a nod to today's tech but a foresight into the preferences of the tech titans of tomorrow, be they human or AI.

Bonus renewable energy, ESG is total bullshit, but it's funny how Bitcoin is the number 1 asset to save the planet, be it advocating sound money or driving renewable energy investments.

Human Capital Magnet: One of the most telling indicators of Bitcoin's potential isn't just its price or adoption rate but the caliber of minds it attracts. This massive influx of human capital — the innovators, thinkers, and visionaries — is a testament to its transformative power.

Bitcoin is so simple and stupid that it is perfect — pure, unyielding, and undeniably the future. Remember, it is still in its infancy and has many risks.

While the S&P 500 stands as a paragon of cost-effectiveness, performance, and simplicity — often outpacing the majority of market participants — Bitcoin elevates these virtues to the next level. If the S&P 500 is the gold standard of traditional investing, Bitcoin is the shining beacon of the digital age.

Conclusion

Bitcoin does not fix everything, but it fixes savings. It is superior savings technology compared to everything else. No, it will never replace stocks in the portfolio, or it won’t be your shortcut to retirement. Undeniably, its role in the global financial system is growing, and as passive investing continues to dominate, Bitcoin is the simplest solution. If you own the S&P 500 index, like it or not, you own Bitcoin a tiny bit already.

Technology and AI is not going anywhere. → Bitcoin.

The distrust of institutions continues to grow. → Bitcoin.

Best yet, being long on technology simultaneously, you flip your finger to governments - Separate money & state.

Bitcoin can also bring profound personal transformation. It certainly made me a better “investor.” Just try it - what can you lose? Did you gain a fresh perspective? For me, it’s been a long journey of self-discovery and growth.

It is all about becoming the best version of yourself and advocating sound money is an integral part of it. Bitcoiners are hopeful about the future. How is it wrong to advocate better ways of living? In a world drowning in fiat's deceit and manipulation, Bitcoin stands tall as the antidote to such corruption. Why cling to a decaying system?

No, it won’t be the end of the world. It gets worse, and then it gets a little bit better. In the end, we always end up better.

As the world grapples with change, Bitcoin offers a glimpse of a tomorrow where value is stored, cherished, and celebrated.

Sources:

https://aswathdamodaran.blogspot.com/2020/10/value-investing-i-back-story.html

https://awealthofcommonsense.com/2023/05/concentration-in-the-stock-market-2/

https://seekingalpha.com/article/4571634-michael-burry-the-passive-bubble-is-deflating