The Modern Economy: A Madhouse of Monetary Illusions

Seeking Financial Sanity - Bet Bitcoin

Weird times we live in. I recall spending a year in St. Petersburg, Russia, where daily life appeared baffling, almost chaotic. Yet, despite all odds, in its unique way, everything just worked.

The current economic landscape feels baffling and chaotic. But can the global economy also find a way to 'just work out'?" We had the fastest interest rate hikes ever from 0% to 5% - Yes, the biggest ponzies (crypto), a few startups, and regional banks went tits up, but everything else works. I was honestly expecting much more “destruction.”

We have/had - My observation:

Record Government Debt: The U.S. debt has soared past a staggering $32 trillion, a towering figure that weighs heavily on the nation's economic future.

Low Unemployment: Despite the looming economic uncertainties, unemployment rates remain at historical lows.

Rampant Inflation: Inflation rates have surged, causing a significant erosion of purchasing power and heightening the cost of living. Yes, now to deflation.

Resilient Stock Market: Despite market corrections, it is not too far from its all-time highs, creating a seeming wealth illusion.

Interest Rate Hike: From the historic lows, interest rates have been aggressively raised to the current 5%, a shift many anticipated would trigger a wave of bankruptcies, yet the economy has been surprisingly resilient.

Minimal Bankruptcies: Despite the stress test of higher interest rates, we have seen only a handful of financial institutions buckle under pressure.

AI and Automation: Technology continues to transform our economic landscape, with AI and automation playing increasingly pivotal roles in boosting productivity and reshaping job markets.

The discrepancy between Economic Theory and Lived Experience: There's a growing gap between the world that economic data depicts and the reality that average citizens are living. Economic growth and rising asset values might paint a rosy picture, but the reality on the ground, with rising living costs and economic inequality, tells a different story.

The discrepancy between Economic Theory and Lived Experience: Can also be flipped. Consumer confidence in surveys was tanking, but now it is getting better. The reality on the ground is that majority still have jobs. My business makes record sales (service industry), and my customers are the busiest ever. None of my friends have been fired, and they are doing fine. Overall everything is “fine.” Why is the confidence tanking, and why not recession?

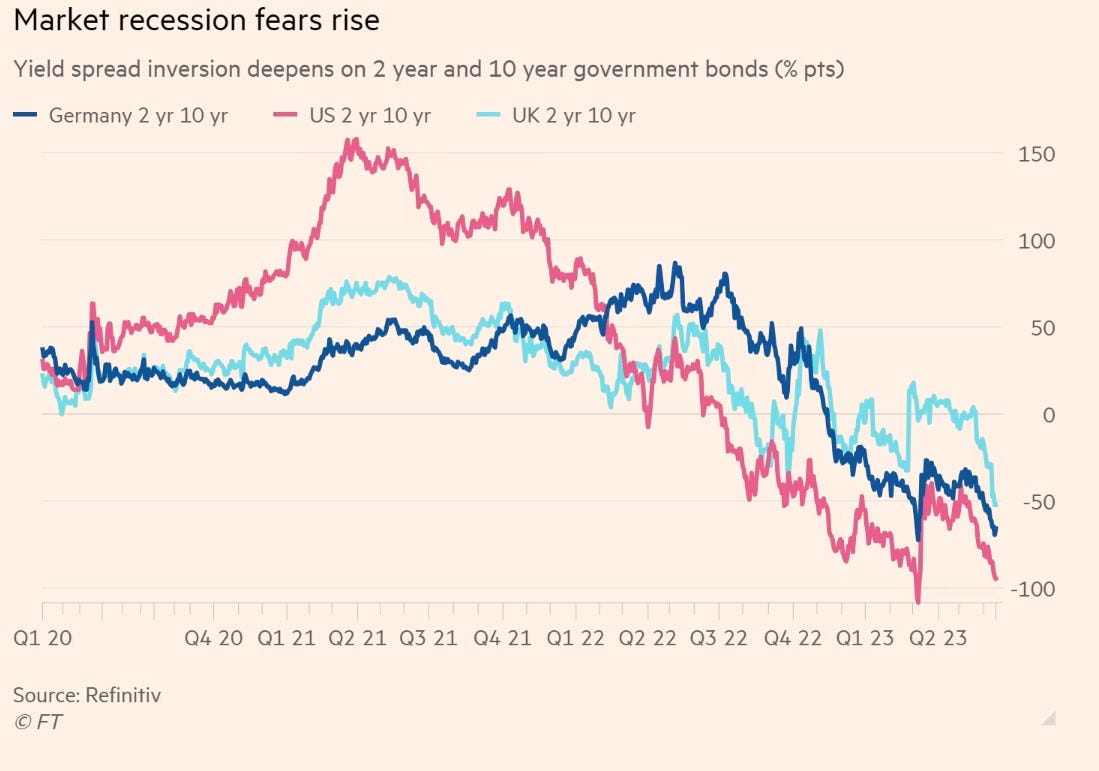

→ Weird times create weird illusions, be it monetary policy, wealth, or how consumers see the economy. Is it all illusions? Narratives change fast, and maybe the squeeze of higher interest rates is yet to come. There are still plenty of zombie companies. Is the process ongoing, and will it go longer? Will we have more bank failures? There is a slowdown going on. All the yield curves indicate that something will happen soon: Rates will go down fast, but when?

What outcomes could there be? These are just for fun - musings of a busy dad and small business owner - think of them as the economic equivalent of “shower thoughts”.

Economic Scenarios: From Likely to Outrageous

Expected Scenarios

The magical soft landing scenario, central banks’ hope, and wishes. The situation where an economy slows down, perhaps after a period of growth, but avoids falling into a recession. One example could be the early 1990s in the US. Then we got the 2000 dotcom bubble… From the everything bubble to the mega everything bubble? Debase everything.

The typical recession, decline in economic activity, business failures, and job losses is another plausible scenario. While extremely painful, but natural for the business cycle and needed for a stronger future.

Alternatively, we could grapple with stagflation, where sluggish growth and high inflation coexist, a combination last seen in the 1970s… The huge trap of monetary illusions, both in personal finance and in policy decisions. Hard to make much sense of anything. Deficits continue to grow…

What could be even worse than stagflation?

Finally, a debt crisis could unravel, triggered by the staggering global debt levels. This could force governments to implement stringent austerity measures, leading to economic contraction and massive socio-political instability. Ukraine - Russia, China - Taiwan… Trust can evaporate extremely fast.

Weird Scenarios

AI singularity is where AI surpasses human intelligence, resulting in unprecedented and unpredictable societal changes. While this concept is more at home in a science fiction novel, the speed of technological innovation makes it worth considering.

Climate crisis. A severe climate event could be a significant economic disruptor with the ongoing global environmental challenges.

The most likely outcome is probably some weird one… Who predicted covid? Nobody thought Ukraine - Russia would escalate to war…

Does it even matter… Silent depression continues, and everything continues to rot.

Amidst all this, the question that surfaces is: Does it matter? As we trudge through this silent depression, we observe a systemic rot nearly impossible to reverse. It's as if the 2008 financial crisis fractured our system in ways we still struggle to mend.

2008 financial crisis broke the system, and the system is unbreakable? Moral Hazard is everywhere - it used to be just bankers, but now it seems to affect our society at every level—the debasement of everything.

Macroeconomic indicators such as GDP, the stock market, and employment figures may suggest a healthy economy, but is it better for many middle-class individuals and families? Everything seems to deteriorate. Are we happier with our gadgets and TV’s etc they are cheaper for sure, but is the life quality better? Or are we just hooked on a cycle of cheap, fleeting dopamine hits?

We are wealthier (on paper), but are we happier? No Collapse Is The Real Dystopia?

Fuck this shit - Bet Bitcoin.

Bitcoin is transparent and simple to understand. Why would I sell the most pristine asset? You hold them—the essence of investing lies in recognizing and holding on to value.

In an era plagued by 'monetary illusions,'’ Bitcoin is a beacon of financial clarity.

I still own some stocks and cash.

Is this a foolproof plan? Of course not. Is it a high risk? Absolutely. But I don't feel it in a world where economic norms seem to be thrown out the window. Remember, this isn't investment advice - just a snapshot of my strategy. It's crucial to do your research. I don’t own a house. I am still long on the “normal economy” through running my business. What other feasible options do I have for storing value? Get a lobotomy and hoard cash? Spend it all constantly because it loses value constantly? “Buy Apple stock like everybody else.” Everybody calls me crazy. Bitcoin is not perfect, but it is the best we have.

Ultimately, I'm more interested in leading a fulfilled life than beating the market. My philosophy is simple – embrace minimalism, practice stoicism, and keep my body and mind healthy with walks and gym workouts. The true victory, after all, lies in attaining freedom. Bitcoin is the ultimate Fuck You, and it is not about Lambos and all that stupid shit.

The future looks messy, but how it looks for my kids? Let’s leave more messiness for future generations? The typical mentality seems to be, 'Let’s save the economy and environment by spending and consuming more and more. After all, in the long run, we are all dead.' How absurd is this mindset?

I want to opt out of this mess - Bitcoin is the way.

Sources and good reads:

https://tradingeconomics.com/united-states/consumer-confidence

https://www.zerohedge.com/political/no-collapse-real-dystopia

https://blogs.cfainstitute.org/investor/2020/02/11/the-silent-depression-trundling-is-the-new-booming/

https://twitter.com/ecommerceshares/status/1669725477538344962?s=20

https://twitter.com/PauloMacro/status/1669425199953977344?s=20

Vide of the month: