The bear case for Bitcoin

What if cycle breaks? For the downside.

I was at BTCHEL last week, and it was a fantastic event. I didn't know what to expect, but it surpassed all my expectations. Very well organized, and I genuinely enjoyed my time there. Will definitely go again.

I didn't hear much price talk, except from the treasury companies, which was refreshing.

Bitcoin will win because of the people around it. The conviction is here, but the road to winning is usually more chaotic and messy than our wildest imagination. Did anybody predict Bitcoin from 2009? Life is always more magical than the movies.

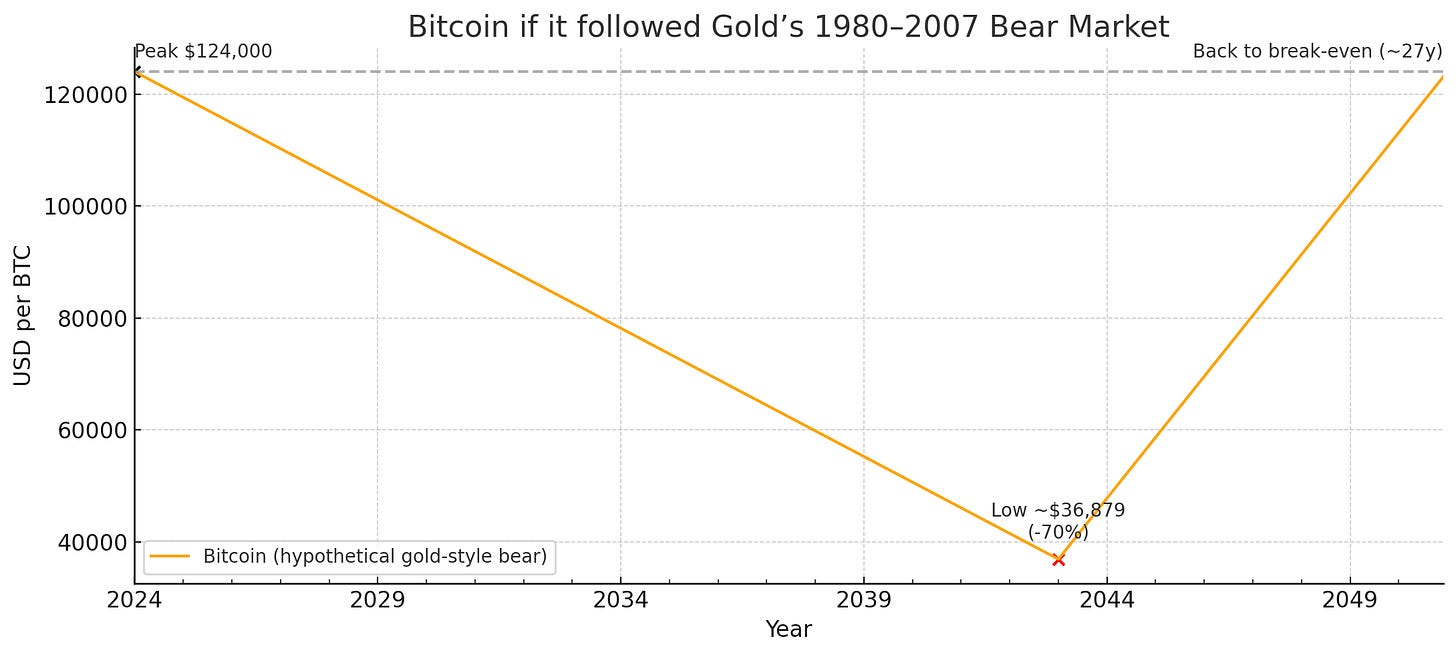

Another asset that everyone was certain would win: gold in 1979?

Gold was the ultimate safe haven after 1971, and peak FOMO hit in 1979-1980, when pension funds, large institutions, and retail investors all raced to buy. There was widespread panic that inflation would spiral out of control.

The setup was perfect for gold bulls:

USD looked increasingly fragile

Oil shocks throughout the 1970s

Inflation running 10-15% by decade's end

Geopolitical tensions exploding (Soviet-Afghan war, Iranian hostage crisis in late 1979)

Media hyping the doom, with retail piling in last

→ Media hyping and doomering, and retail piling in last.

Well, the dollar didn't die. What happened?

Volcker's rate shock (1980-1982): Fed Funds peaked above 19% in 1981. Tight monetary policy broke inflation by the mid-1980s. The U.S. dollar strengthened, especially under Reagan.

The consequences cascaded: → A strong dollar crushed dollar-denominated commodities, including gold → No crisis = no safe-haven demand → Equities outperformed massively (S&P 500 compounded >15% annually in the '80s-'90s)

Gold became "dead money." Boom to bust.

Would Bitcoin survive a 20+ year bear market?"

So what scenarios could create Bitcoin's version of gold's lost decades?

Bearish for hard money (Solid money, people = win)

Strong Dollar, High Real Yields, Low Inflation ("Goldilocks for bonds") Story: Productivity uptick + restrained deficits → core inflation ~2%, 10-yr real yields 2-3%, dollar stays firm.

AI-Driven Disinflation Boom Story: AI + automation lower unit costs, raise margins, and anchor inflation near 1-2% while growth stays decent. PRODUCTIVITY GROWTH!

But keep an eye out: Nobody talks about how expensive AI actually is. Remember when ChatGPT launched? 10x more expensive than Google search. You still need humans inserting data, prompting, governing what comes out. Better productivity? Maybe. Maybe not.

No Crisis = No Safe-Haven Demand Story: Ukraine-Russia becomes the last major conflict for decades. Geopolitical calm.

Less Government = People Winning Story: Credible multi-year fiscal plan + confidence in fiat institutions rises + better growth mix + lower taxes.

Bearish for hard money (People = Losing)

The Gentle Strangulation KYC/CBDC requirements only increase (especially in the EU). USA rolls out new stablecoin regulations. They still control the on/off ramps, and yeah, I'd prefer stablecoins over CBDCs, but it's all "redollarization. Why do they do this? More demand for T-bills. The perfect trap.

The "cryptobros" win too → 24/7 yield for digital dollars, RWA growth, more financialization ponzi. The Bitcoin narrative loses to yielding digital dollars that "just work" for average consumers.

The 1984 Digital Gulag AI + CBDC + social credit. The only successful use case for AI right now? Surveillance.

Every transaction monitored, scored, and controlled. Bitcoin possession = thoughtcrime.

The biggest blindside for Bitcoiners?

We have a hard time imagining competent policy responses. Real growth. Smart spending cuts. Surgical capital controls. The majority is still doing just fine in the "system" (or they think they are).

Are we too optimistic that the "normies" will get it? Look what's happening in the UK. The same is coming to Europe. Russia is already there with 24/7 control through digital infrastructure. The majority of normies love the compliance - they're highly competitive at following rules.

It's incredibly hard to talk about privacy, freedom, what money actually is. Do they care enough?

The difference now? Instead of midnight arrests, it's account freezes. Instead of gulags, it's social credit scores. Instead of informants, it's algorithmic surveillance. The machinery is more elegant, more accepted, and infinitely more scalable. By the time people realize what they've lost, the game is already over.

For me, it took 9-10 years to truly "get it." Bitcoin doesn't need everybody; it just needs to survive. All I'm saying is that Bitcoin's victory will take longer than we all hope. Many more bear markets ahead. Many moments when it feels like the state has won.

But the same conviction I felt at BTCHEL will carry us through: we're building something bigger than ourselves.

Bitcoin doesn't care about our hopes or our impatience. It just keeps running - tick tock, block by block - quietly offering the exit ramp to anyone paying attention.

Stay strong and stack sats,

Sources:

Hopefully next year too!

https://btchel.com/