Solar Foods: Masters of Alchemy

Cash to Ash

Disclaimer: I'm just a random jester writing a blog post, doing a quick smell test on whether this investment is viable. I don't enjoy writing this kind of shit. I wish everybody success. But someone's gotta play the fool.

I have talked recently about the “cryptofication” of all the markets, and now, in Helsinki, we have a new listing that represents more of a “crypto project” than an actual business. It is more about selling dreams & hype, ultimate speculation.

Reduces Carbon Emissions = Energy-efficient Proof of Stake (PoS) Farming bad = Bitcoin bad

No Agricultural Footprint = Decentralized Network with Low Resource Use

Disruptive Potential: (Food market) = Disruptive Potential: (Finance)

Innovation driven by sustainability: Both Solar Foods and Cardano focus on sustainable alternatives to traditional systems (food production vs. financial systems).

Hype vs. Reality: Both are surrounded by futuristic hype but face significant challenges in scaling their technology and gaining mainstream acceptance.

Technological Optimism: Both promote “science-backed” solutions to global problems (What problems?), yet the road to full adoption is long and uncertain.

✅ How will this make money?

✅ Is the technology commercially viable at scale?

✅ When (if ever) will the company become profitable?

In the world of startups and innovation, critical evaluation is crucial. Friends and family should offer honest feedback on business ideas, potentially saving entrepreneurs from financial hardship and personal strain. Unfortunately, some ill-conceived ventures progress far beyond the drawing board.

Even questionable ideas can gain momentum in today's fast-paced investment climate, where money was free for over a decade. A startup might secure initial funding, attract government subsidies, and draw in waves of investors. As capital flows in and valuations soar, it becomes increasingly difficult for voices of reason to intervene.

Can we separate the revolutionary promises from the cash-burning reality?

The suits are celebrating that we finally got a new listing in Helsinki, but is anyone brave enough to call out the elephant in the room? We should be careful what we wish for. I'm increasingly concerned about the “investability” of Helsinki's market. How are we supposed to sell this to foreign investors when we're letting companies like this slip through?

Let them have at it if this were purely private money. Want to burn cash trying to make food out of thin air? Be my guest. But that's not what's happening here. Solar Foods has been guzzling government subsidies like there's no tomorrow. And now they're going public?

Why does no one have the courage to say, “Maybe this isn’t ready to go public yet?”

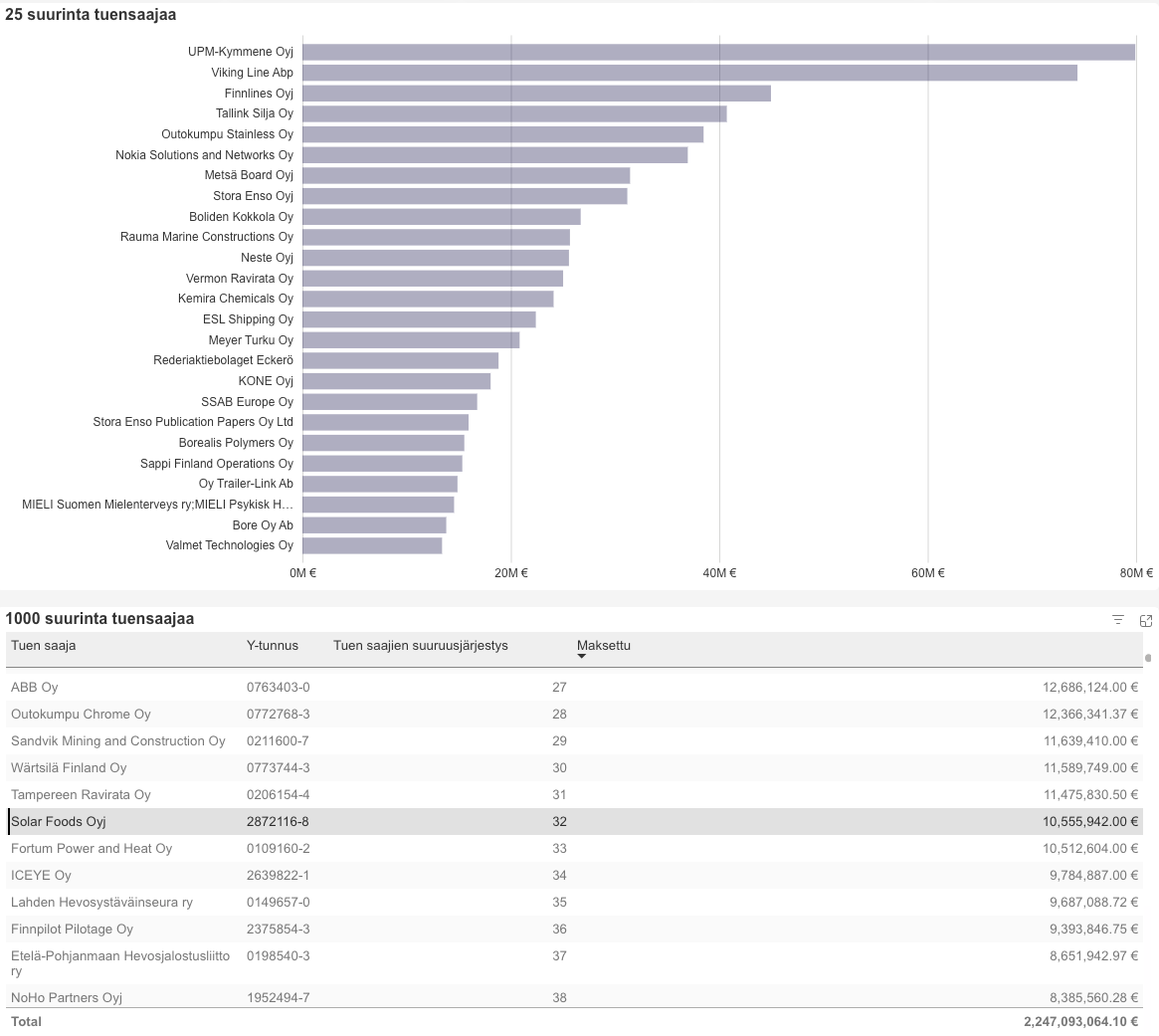

The subsidies:

These corporate subsidies need to end immediately. Continuing to support them is idiotic. If you're in favor, fine, but let's call it what it is - blind allegiance to a broken system. It’s frustrating to watch this maddnes.

That is an excellent move to pivot to hydrogen; well done. Get even more subsidies.

Why are taxpayers footing the bill for unproven food technology? Are we running out of protein sources?

A €34 million grant, with the potential for up to €110 million in state aid? This isn't just innovation funding; it’s a prime example of how easy it is to write checks when it’s not your own money at stake. It’s the classic welfare state approach - lavishing funds with little regard for real-world financial discipline or accountability.

If this technology is so groundbreaking and commercially viable, why can't they attract private investment instead of suckling at the government tit?

What's the ROI for taxpayers here? Are we going to see cheaper food prices and more jobs? Or what the fuck?

How does this align with the EU's goal of responsible spending and market fairness? It seems like we're picking winners, which is disgusting.

This isn't just about Solar Foods anymore. It's about a system that seems all too eager to throw public money at shiny “projects” without asking the hard questions. It's about market integrity in Helsinki and beyond. And most importantly, it's about whether we're creating real innovation or just subsidizing dreams. Start calling the fucking bullshit. You are paying for this.

The positives

If Solar Foods can deliver on its promises, the potential benefits are significant. A protein source with minimal environmental impact would be awesome, and cheaper food worldwide would be awesome, so it's double awesome.

Is it Solar Foods fault that they receive a massive amount of subsidies from taxpayers? Would it be better if taxation was better structured and incentivized for growth and risk-taking? In Finland and Europe, there is zero reason for risk-taking and growth. In reality, they’re working within the existing system.

High taxes discourage high-risk, high-reward innovation. Solar Foods is simply doing what it must to survive and thrive in an environment that offers little reward for boldness and risk-taking.

The real question is: should we blame the player or the game? Maybe if taxation were better structured to incentivize growth and risk-taking, we'd see more genuine innovation and less subsidy-sucking.

While dreaming big is admirable, responsible innovation also requires balancing ambition and realism, which seems difficult to find here. However, it’s still respectable that Solar Foods is attempting something bold and disruptive, even if they're relying on taxpayer money. In a system that doesn't reward risk, they are still trying to push boundaries, and that deserves some respect.

It’s easy for us keyboard warriors and jesters here on the internet to critique from the sidelines, but critique alone doesn’t build a thing. Meanwhile, the founders of Solar Foods are out there, risking it all on an unproven dream. And as much as we critique, we must admit that their courage moves the world forward.

Red flags

1. Ongoing Losses and Cash Burn

Losses of nearly 9 million in 2023. In 2023, they still had their pilot factory running in a garage. 2024/4 Factory 01 started to run; how much does that burn cash?

Solar Foods raised 8 million in the 2024/4 Springinvest round - well done! The auditor highlighted “material uncertainty” about the company’s ability to continue.

Update on new materials. They say they have cash on hand 24 million, which should last at least 12 months.

After the end of fiscal year 2023, the company raised about 8.7 million euros in new equity capital through share issues.

They received about 9.3 million euros in grant payments based on the IPCEI funding decision.

They said the Factory 2 would cost 310-420 million euros.

The stock will go BRRRRRRRR.

2. Heavy reliance on government grants/subsidies

Nearly all of Solar Foods income is coming from government grants and IPCEI funding, with no commercial revenues to date. So, the question remains: who’s going to finance Factory 02?

3. Unproven commercial viability

Factory 01 is operational, producing its first Solein batch in February 2024. They claim it demonstrates 100x scale-up from pilot stage. But where are the actual production numbers or efficiency metrics?

Some regulatory progress: self-affirmed GRAS status in the US (September 2024).

They claim profitability "when it scales" - a vague assertion without concrete data to back it up. This lack of transparency is a huge red flag.

4. Aggressive growth projections

They're dreaming big: 1,320M€ revenue and 680M€ EBITDA.

The pitch? A massive 2,000 billion euro protein market. Sure, alternative proteins are growing, but this is starting to feel like a crypto project. Like in crypto, the numbers quickly spiral into fantasy land, designed to sell dreams rather than reality.

It's the classic playbook: paint a picture of endless potential and possibilities. Dreaming is fine, but don't get hooked. The more you buy into the dream, the more likely you are to buy in... period.

We're approaching "John McAfee dick prices" level projections here. Where's the actual path to profitability in all this hype?

5. Frequent capital raises

Given the burn rate, the company has raised funds multiple times and will likely need more capital soon.

2023/10-11 - 8milj with Springinvest 180milj valuation.

2024/4 - 8milj with Springinvest 210milj valuation.

Surprisingly, they got fully funded both times. Kudos for that.

So, how much money does Solar Food need? Will the funding carousel ever stop?

6. Valuation concerns

The 200+ million euro valuation seems high for a pre-revenue company with significant uncertainties.

Well, it's a 2000 billion market! Where are the products? Even concepts? They had the license in Singapore for a year. Anything? Fazer is one of the seed investors. They did not come up with anything?

If this miracle substance is so stellar, could they at least sell it as a gardening fertilizer? Or how about animal feed?

So, what are we valuing here? Dreams? Promises? The ability to turn government grants into PowerPoint presentations?

Well, they have made some progress since the Springinvest: Solein® takes its next step towards commercial use as leading Japanese food manufacturer the Ajinomoto Group unveils two new Solein-powered products: Traditional Flowering Mooncakes and Ice Cream Sandwiches.

7. Rushed listing

Going public just 6 months after a private fundraising… They said in the private fundraising that listing could happen earliest in 12-24 months, 5 months later and they are doing technical listing?

Their stated purpose - enabling global expansion and growth strategy implementation (Solar Foods 2024/9).

This sounds like corporate jargon that doesn’t match the actual situation. It reads like a smokescreen, so it is maybe total bullshit.

Some notable improvements from the Springinvest round remain, but these don't fully justify the rush to list.

Real motive?

It is likely an exit opportunity for early investors/founders.

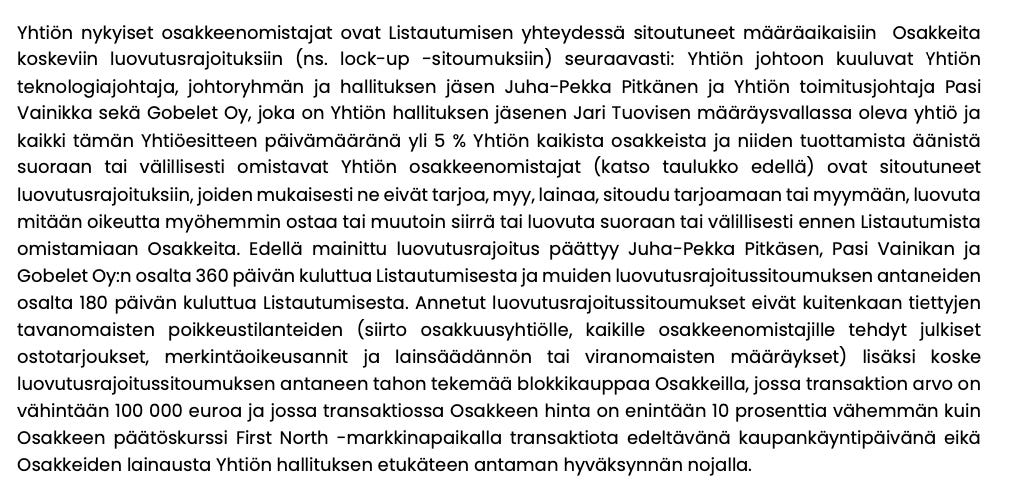

Lock-up provisions:

180-360 days for management and >5% owners.

Loophole: Block trades allowed, enabling significant early sales.

Suggests a lack of long-term commitment.

The timing, technical listing nature, and flexible lock-up rules indicate that early liquidity is prioritized over long-term value creation for new shareholders.

+ Bonus - Extremely crowded and struggling market

There is vast competition in alternative proteins. Have any of them gained real traction? How can Solein?

Quorn, a pioneer in mycoprotein, launched in the 1980s. It took decades to gain traction. Today, sales are around 200 million/year. The UK remains its largest and most established market.

Beyond Meat:

The entire alternative protein sector has experienced slowing growth and market saturation in recent years.

Is Solein so revolutionary that it can succeed where others have fumbled? This time, it's different. Solein is revolutionary!

Sure, and every alternative protein claims to be revolutionary. Even if you can make protein from thin air, can you make consumers line up to buy it? No matter how cool your tech is or how different you are from other proteins, the million-dollar question remains: Can you make money?

Conclusion

Even a single red flag should be enough to send investors running for safer pastures. When you start prioritizing dreams over reality, you're not investing; you're gambling. If you want to gamble, it is ok - you can do whatever you want with your money. When governments and the European Union start to fund this kind of pipe dreams, you should not be okay. Call the bullshit.

What's the real path to profitability?

Even if you take the most bullish scenario for Solar Foods and multiply it by 3x, does this still make this a profitable investment? Well, let's wait until 2035 and beyond when this supposedly starts to make money.

The real issue here isn't just one company's questionable path to profitability. It's about the integrity of our markets and the responsible use of public funds. Solar Foods represents a disturbing trend in which hype, government subsidies, and FOMO converge to create a perfect storm of misallocated resources.

This jester wonders as Solar Foods prepares to go public. Are we witnessing the birth of a revolutionary alternative protein company or just watching as public funds evaporate into thin air? Only time will tell, but by then, it might be too late for investors and taxpayers alike.

I do hope I am entirely wrong and will be humiliated by this big pile of shit I wrote above.

Sources:

https://app.powerbi.com/view?r=eyJrIjoiODI4ZTBhY2UtYjRhMC00M2UwLWE1MGItODNjYWZlYjA4ZTNkIiwidCI6ImQ5NTk1MWE2LWRmZDMtNGE3NC05YWJiLWYyYjJjYjg5ZDY3MSIsImMiOjh9

https://solarfoods.com/solar-foods-obtains-self-affirmed-gras-status-for-solein-in-the-united-states/

(Solar Foods 2024/9)

(Solar Foods 2024/9).

https://www.quorn.fi/mycoprotein

https://www.inderes.fi/articles/solar-foods-julkaisee-yhtioesitteen

What to Watch: After listing:

Management/owners selling? Buying?

“Community” starting to form around Solar Foods?

“You need at least 100 hours of study to understand Solein."

More hype? Change the narrative?

More dreaming is needed to get more liquidity.

Are actual products hitting the market?

Financials?