Nintendo's Untapped Potential: Great Company or Great Investment?

Beyond the Mushroom Kingdom: Assessing Nintendo's Financial Performance and Future Growth

You hope, dream, and pray, but in the end, you get nothing, not even disappointment; you have become numb to it.

A great company does not necessarily mean that the stock is great. I like Nintendo a lot and grew up playing Mario and Nintendo games, NES and then SNES. We just went to the movies with my son to watch a Mario movie, and I liked it. My son loved it. Every kid under ten here in Finland is at least crazy about Mario.

Will Nintendo finally take advantage of its massive IP and expand to the entertainment business?

Is the stock worth investing in?

Paradigm shift?

Software is doing wonderfully now, and they are taking more out of the IP. This could be a hidden value gem with very low risk and huge growth potential.

Business Overview

Nintendo, founded in 1889, initially started as a playing card company but eventually transformed into a global leader in the video game industry. Next to entertainment?

The company has brought to life some of the most iconic gaming consoles and characters, such as Mario, Zelda, and Pokémon.

Nintendo's product portfolio: video game consoles, games, and accessories.

I like the company a lot: Weak sales? CEO PAY CUT. They are genuinely trying to do good. Yes, they have their occasional weirdness (hate for esports for eg), but compared to Western companies that are run purely by greed and moral hazard - I wish more companies would be like Nintendo.

Creating smiles for generations

The latest hardware is the Nintendo Switch, released worldwide in most regions on March 3, 2017. New hardware is coming in 20XX.

I am not so interested in new hardware in the long term. Nintendo’s competitive advantage is not hardware but software and IP. They are getting it slowly. My kid is playing the same Mario games as I did as a kid, and he loves them. It is a paradigm shift.

Make the hardware irrelevant - Win our hearts. Let Sony and Microsoft compete with their specs and graphics. Competition is for losers. The Nintendo Switch OLED launched on October 8, 2021. Just minor upgrades from now on, like mobile phones?

This is just starting. Nintendo can do so much more and truly transform into an entertainment juggernaut.

Nintendo has a rich product portfolio, including video game consoles, games, and accessories. The company is now focusing on capitalizing on its IP in the entertainment industry.

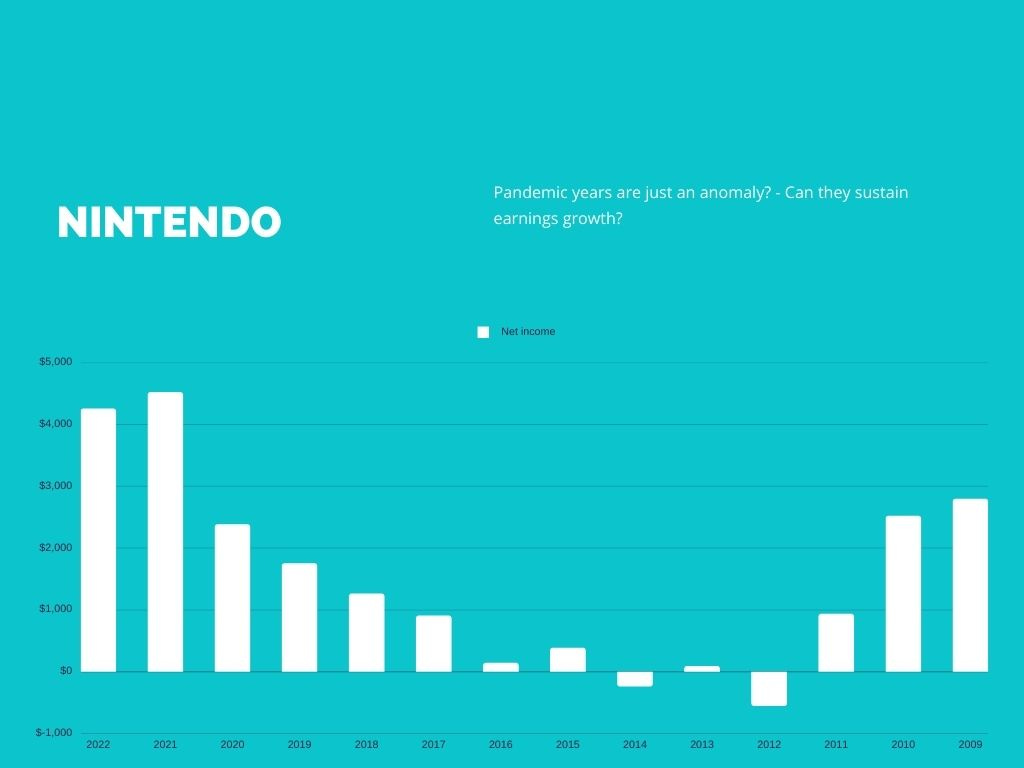

Financial Performance

Overall, the company's revenue and net income have shown a positive trend in recent years, reflecting the successful launch and continued popularity of the Nintendo Switch console. The pandemic also helped massively.

Nintendo maintains a solid balance sheet with an extremely healthy cash position and manageable debt levels.

The Japanese mentality is to hoard cash. Nintendo's cash on hand for 2022 was $15.227B.

Opens room for acquisition.

It can weather any upcoming storm. (see the failed WII U 2012-2016)

Capitalize on growth opportunities when they arise.

Stock buybacks in the future?

→ Nintendo's latest twelve months ev / ebit is 7.9x

→ Nintendo's latest twelve months p/e ratio is 13.9x

Nintendo's financial position is robust and resilient, with a strong balance sheet and healthy cash reserves. Can they sustain profitability?

Nintendo has experienced positive revenue and net income trends in recent years, supported by the success of the Nintendo Switch. The company has a strong balance sheet and cash reserves, which can be utilized for future growth opportunities.

Sustainable profitability?

Let’s do a simple exercise and DFC analysis on Nintendo:

We can change and adjust the numbers how we like and make the numbers look just like we want.

Moderate growth

Free cash flow around 1,4BN (average from 2009 - 2022)

Growth 5% for 10 years (average from 2009 - 2022)

Intrinsic Value per Share ≈ $13.94

Mario is dying and fading scenario.

Free cash flow around 300 million (WII U - times)

Growth 2% for 10 years.

Intrinsic Value per Share ≈ $2.91

Mario and Nintendo conquer the world - Growing like Apple from the launch of the Iphone “Paradigm shift.”

Free cash flow around 4BN (Record)

Growth of 20% for 10 years

Intrinsic Value per Share ≈ $133.29

The current stock price is around $10 - I would say it is fairly valued. Currently market does not believe Nintendo can keep its profitability at “pandemic” levels.

I believe Nintendo can make money in the future and sustain at least “moderate growth”. Sales are also currently driven by software, so margins stay lovely.

Different growth scenarios based on DFC analysis suggest that the stock is fairly valued at the current price. However, there's potential for significant upside if Nintendo can capitalize on its IP and maintain profitability.

Nintendo - Biggest risks.

The most significant risk of Nintendo is Nintendo itself—all this kind of weirdness, banning youtube content, resending its fans so much?.

Releasing weird software and hardware - look at WII U.

What if they decide to do some weirdness again? They are pushing hard on some VR, making hardware that they have to sell at a loss and nobody wants, WII U all over again, and putting ten years of income down to the drain. Would you be surprised?

How about Nintendo's online offering? Weird.

The Nintendo Switch Online is a nice value at 20$ a year. You get NES and SNES games. Then they offer an “Expansion pack” with Nintendo 64, GBA and SEGA + some DLC for Nintendo games for 50$ a year. This is extremely weak compared to the competition.

→ It is very hard to see massive growth and sustainable profitability in the long run if the online offering is so weak.

What I would love to see.

Keep just upgrading the switch incrementally - Nintendo fans and kids don’t care about top-tier graphics. They want Nintendo games.

Do a compelling online service. How bout a give us all the retro games for 5$/month? Do some Xbox game pass-style subscriptions with Nintendo games? Hello, anybody out there?

Increased IP Utilization, one movie is a start, but this extraordinary IP portfolio has many more opportunities - Will Nintendo ever capitalize on them?

Hard to see Nintendo not continuing to be a little bit weird in the future, its the biggest risk for Nintendo. Nintendo being Nintendo.

Major risks for investing in Nintendo include the company's decision-making and potential cultural challenges. Strengthening its online offerings and effectively leveraging its IP can help mitigate these risks.

Conclusion

Nintendo is a wonderful company with lovely products, games, and a fantastic movie.

The stock is fairly valued, and I would even say slightly undervalued compared to the rest of the market (everything is still overvalued, IMO).

Why would I want to own Nintendo stock? I don’t want more headaches in my life.

Even with the Mario movie's massive success, it is very hard to see them change. They will continue to be “weird” in the future.

You hope, dream, and pray all the best for Nintendo - But hope is a shit strategy and will always end in disappointment. I want the price to be lower or see real change happening in Nintendo before considering owning a piece of Nintendo.

Nintendo still has wonderful potential and a small glimmer of hope that it can change.

I will follow Nintendo closely and enjoy the games and movies with my kids, but I will not invest in Nintendo this time. Nintendo is a fascinating company with great potential.

Sources and good reads:

Read: https://www.crossroadscap.io/investor-letters/annual-letter-to-investors-2021

Discounted Cash Flow (DCF) method: Extremely rudimentary just for fun here.

Intrinsic Value per Share = (Σ(Present Value of FCFs) + Present Value of Terminal Value) / Number of Outstanding Shares

For the "moderate growth" scenario, we used the following assumptions:

Initial FCF: $1,400 million

Constant growth rate: 5% for 10 years

WACC (discount rate): 5%

Terminal growth rate: 2%

Number of outstanding shares: 4.66 billion

Using these assumptions, the formula for calculating the intrinsic value per share for Nintendo becomes:

Intrinsic Value per Share = (Σ(Present Value of FCFs with 5% growth for 10 years) + Present Value of Terminal Value with 2% growth) / 4.66 billion

Plugging in the numbers and straight up create value!