New listing - Nokian Panimo

Why the hell am I interested in a €20 million microbrewery - in arguably the toughest market on earth?

The Finnish stock market has been riddled with vaporware cryptoesquet “projects” as IPO. Nokian Panimo is a breath of fresh air - exactly the type of solid, authentic business Finland needs more of. This isn't another flashy gamble; it's a real, profitable company built on steady growth and a strong, recognizable local brand.

Back when I invested in Olvi, my sauna beers tasted just a bit better, knowing I was a part owner. Those were simpler times. By 2019, I'd sold off all my Finnish stocks and property. Today, I don’t even drink beer anymore. Yet, Nokian Panimo has genuinely captured my attention.

Buy Thesis:

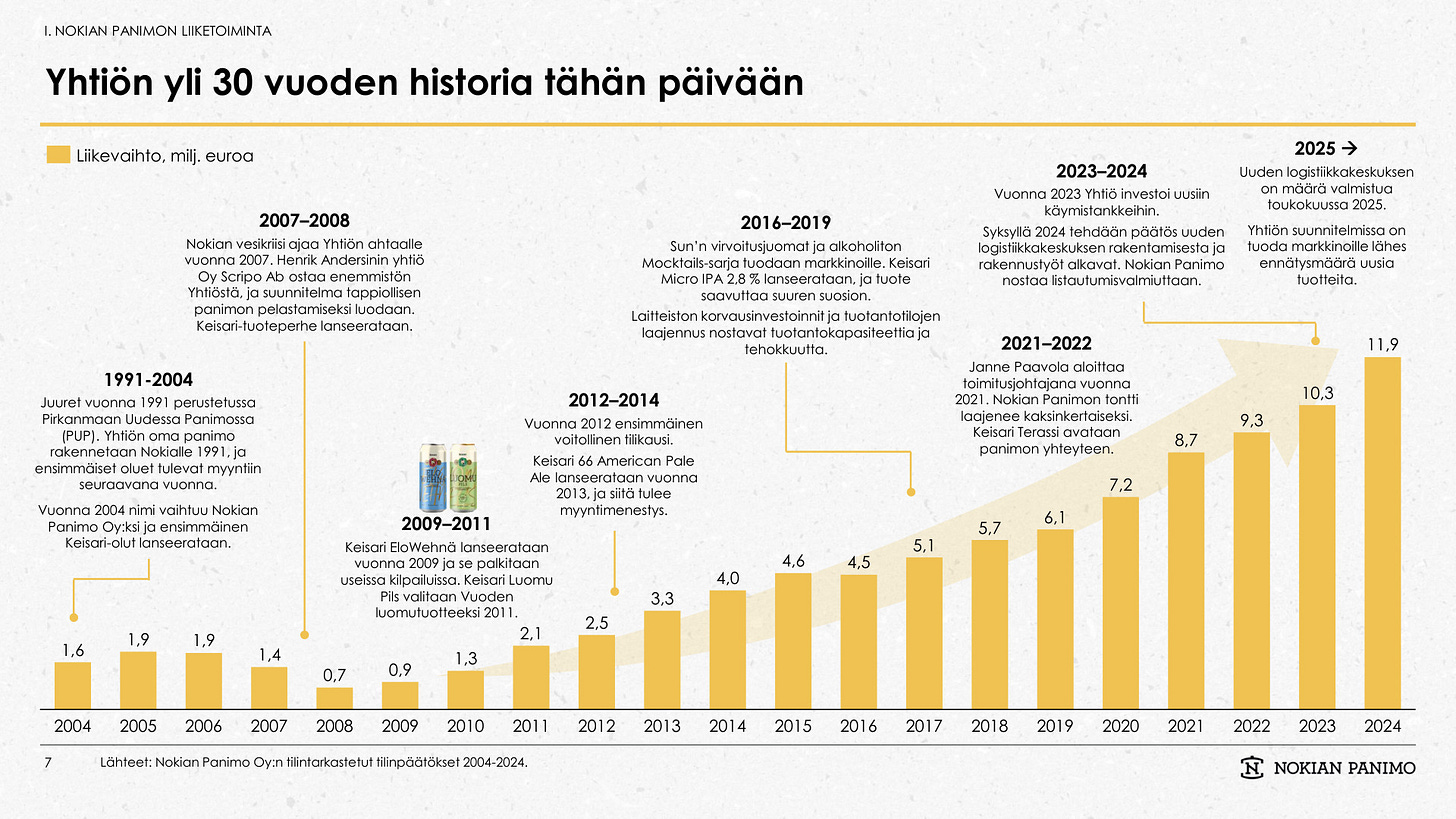

📈 Breweries often come and go, but this one has stayed the course for three decades.

📈 Strong, Committed Management (From 2007-2008). This team has steered the company through shifting consumer tastes, tighter regulations, and fierce competition - proving resilience and adaptability in an incredibly hard industry.

📈 Local Brand with Non-Alcoholic Momentum. While “Keisari” beers anchor the portfolio, the company has also ventured into non-alcoholic mocktails and craft sodas. That aligns with a growing consumer shift toward healthier, low- or no-alcohol alternatives - They have the best offering here in my opinion. There is a huge opportunity here; the bigger breweries adapt slowly.

📈 This isn't some risky moonshot; it’s genuine entrepreneurship, Finnish through-and-through. They employ local people, source domestically, and proudly market their Finnish authenticity.

📈 Good margins and profitability in a harsh industry. Nokian Panimo is demonstrating a disciplined approach rarely seen in today’s market. Show me another up-and-coming brewery with consistent profitability in such a punishing sector.

📈 The IPO looks good! Owners not selling, good ownership structure. Some institutions are on board. Refreshing, even in Finland! (Look past IPOs in Finland?)

🚩 Raw material costs

🚩Competition is fierce

🚩 Dependency on "small brewery" tax advantages.

🚩 At around a €25 million market cap post-IPO, valuation sits in the low 20s.

Why the hell am I interested in a €20 million microbrewery - in arguably the toughest market on earth?

Fair question. Honestly, I just respect their products and the grit of Finnish entrepreneurship. I’m not banking on a quick buck; this is a slow burn, especially with a 20+ P/E ratio. Yeah, you could argue “just buy Carlsberg or Olvi at that valuation,” and you’d be right if you’re chasing purely metrics. But come on, look at how most people trade: bullish one day, bearish the next, buying high and panic-selling low.

Nokian Panimo is the quintessential “low time preference” play Finland needs: slow, steady growth, real profitability, and an authentic brand that stays true to its roots. You want to support Finnish production and local sourcing? This is your shot. I buy 100% local meat for my freezer - why wouldn’t I invest similarly in my drinks?

So why not embrace a little Peter Lynch spirit, toss a small stake here, and remember that genuine wealth-building thrives on patience, quality, and authenticity. It’s time to back the kind of company that keeps Finland awesome. Bought €50 worth of their beer? Maybe match it with €50 worth of the stock. If the product is trash, skip both. Simple as that.

Bonus: Know what you own.

Sources:

https://www.nordnet.fi/kampanjat/listautumisannit/nokian-panimo