Is it too late to Buy Bitcoin?

Simple Insights for the working individual wondering - Am I Too Late?

Have you been cruising on autopilot, comfortably numb to the financial shitshow around you?

Yes, the Bitcoin price is soaring, and now you are interested?

This isn't just about winning or losing - it's about unlocking a door to curiosity.

Before you take the dive, ask yourself: Are you confident in your ability to see things through, or are you just chasing after a fleeting rush without any real commitment?

A commitment to educate oneself beyond the surface-level hype?

There are no shortcuts. Bitcoin's number-up technology is alluring, but its true value lies in its ability to redefine our understanding of money, investment, and economic freedom. True wealth lies in knowledge, not just digital coins.

Life on autopilot — get an education, work, buy a house, save. Rinse and repeat. Dabble in stocks, ETFs, maybe crypto, only to dabble and panic-sell at the next market dip?

Stop.

Get curious.

It is never too late to take responsibility for your finances. Even if it is crazy and hard, you can do it! This digital coin, Bitcoin, invites us to rethink everything.

There is freedom technology, and it is Bitcoin.

Oh, it’s so late to adopt freedom technology…

Still there? Read the following three times:

First Global

Private (no government oversight)

Digital rules-based

Monetary system

What is money? How do I store my wealth? What is wealth? What is a store of value? How do we secure wealth, and what even is “wealth”?

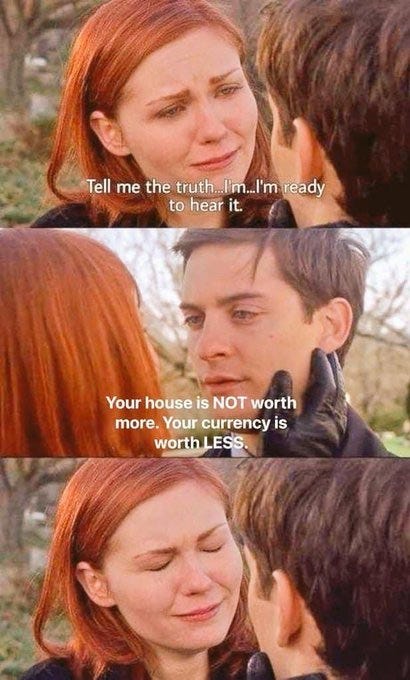

The best time to buy was yesterday, and the second is today. Yes, you have heard this all your life… Buy your own house and get on to the property ladder it is a guaranteed wealth escalator.

Is it anymore? It certainly used to be. Currencies around the world will continue debasement. What asset has the highest probability of storing your fruits of labor in the future?

The purchasing power of 100 euros over a 5-year period:

The issue at hand is your time preference, which appears to be only slightly more forward-looking than that of a monkey. You're planning for the next week, but what about five years from now? Ten years? 30 years? To whom do you plan to sell your assets in 10-30 years? Take a moment to observe the changes unfolding in our world rather than burying your head deeper in your arse. Why did our time preference get so high? Get curious.

Why do I advocate Bitcoin so much? I’m tired of watching everything decay slowly. What kind of world are we leaving for our kids and future generations? Instead of worrying, why not become a debt slave?

Those days are gone when you can make up quick gains (less than a year):

2013 from 13$ to 1100$

2017 from 1000$ to 20 000$

Bitcoin is just a 15-year-old asset. It has reignited my youthful optimism, offering a glimpse of a different future. The pessimistic in me says this is naive, and it is just a populist movement that drains resources from those seeking quick wins or chasing dreams. Or luring idiots like me who cannot write anything intelligent. It still is just a 1.3 trillion asset today. It challenges us to stay curious.

Get curious

Look what Bitcoin has achieved in 15 years. What can it do in the next 5? 10? 30 years?

I am hopeful for a world that is more driven by curiosity, it’s for the better.

Is it too late to get curious?

A world driven by curiosity over complacency? That's a world I'm hopeful for.

Resources to get started:

https://www.kiiskiunfolding.com/bitcoin-resources

Sources to this piece and good shit:

https://bitcoinmagazine.com/glossary/debasement

https://twitter.com/freddienew/status/1767132459257237659

For people living in Finland, try it with your own salary!

https://www.stat.fi/tup/laskurit/rahanarvonmuunnin.html

https://x.com/BitMan_PoW/status/1768712691491729608?s=20

For the more financially savvy to ponder:

“This is by far the best asymmetric bet that you can make because even in very low probability scenarios…the upside potential, we’re not talking about 10x, it could be 100x in a very quick period of time if it really captures the monetary premium of these assets.” — Raphael Zagury