Is Bitcoin good hedge against everything?

Not yet, but will be one day... Maybe.

Bitcoin is still just a 1.2 trillion asset. Is it big? Small? Tiny?

From 2022 November gold added 3 trillion to its market cap while Bitcoin added 0.8 trillion. Central banks and governments around the world are currently hoarding gold, not Bitcoin.

Gold has one big advantage, and it is recognition. History over 5000 years vs 15 years.

Inflation hedge:

What a way to hedge against Inflation. Do you still remember the 2021 all-time high in November, 67k? The Inflation call was spot on. CPI peaked over 9%, while Bitcoin dumbed to below 20k in 2022. The best ponzies in crypto got totally smoked by Luna and FTX, so it was a beautiful capitulation.

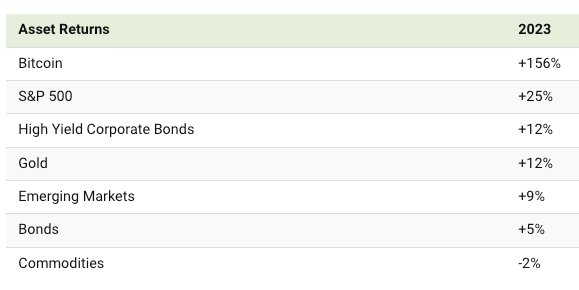

Gold did surprisingly well despite rising interest rates and a strong dollar, cementing its position as a top-tier safe-haven asset. (S&P 500 down -20%, Bonds 15-20% Bitcoin -60%).

Bitcoin and gold are both performing wonderfully despite high interest rates. Positive real rates won’t last long? Inflation expectation? More Wars? More wtf clown-world?

Systemic risks:

The scariest word on the planet. Does it matter nowadays? Let’s bail out everybody.

The crisis, which peaked with the collapse of Lehman Brothers in September 2008, led to a global financial meltdown. Well, what do you do when you get margin called? You have to sell your gold.

The dip was bought, and gold peaked in 2011 amid of EURO crisis.

Bitcoin was born: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

That was the message contained in Bitcoin’s first-ever transaction block on Jan. 3, 2009.

→ Direct response to the systemic failures and lack of trust in traditional financial institutions. Decentralized solution.

2023 banking crisis

Well, was the Bitcoin performance due to hedging of “Systemic risks” or just hopes and dreams of interest rate cuts by FED and speculation on the upcoming Bitcoin ETF launch?

A little bit of both. Certainly, the interest and questions I received spiked during this. Still, the majority was betting on it to speculate.

Bitcoin's strongest point is zero counterparty risk. It is the only asset that you can control and hold on a 100%, pure peer-to-peer network; no banks or governments are needed. Not your keys, not your coins; if the exchange becomes insolvent, you lose your coins.

Gold can reach a similar level of counterparty risk, but it is very difficult to store, move, and safeguard.

This is the biggest reason I want to own Bitcoin. The majority is still not grasping this idea: Store value and send value no matter what happens. This will take many years to grasp. There is no second best.

Hedge against debasement

Bitcoin is a hedge against a loss of purchasing power. The same goes for gold.

What is happening in Argentina, Turkey, Nigeria, Egypt, etc? The list could go on… Currencies lose value as a result of reckless monetary & fiscal policies. Bitcoin is still a luxury due to it being so small (massive swings still occur, who can predict Bitcoin price next month? 50-80k, idk). If I were working in Argentina, 2.5 jobs I would want to own dollars and do everything I can to feed my family, “Just save in Bitcoin”, save exactly what? No money! No luxury to even dream of saving anything.

The dollar is the best FIAT currency compared to others, but they are all getting shittier and shittier all the time. This will be a pretty rude awakening for many; look at how living costs and purchasing power are eroding in Europe, Canada, Australia… Yes, FIAT currencies will go down to the toilet, but it will take decades again (For the dollar, at least).

I can and will take the bet that Bitcoin will become the ultimate technology to preserve my wealth.

If you think there is a 1% chance, You bet this fucker.

The strongest one tends to eat everything in the end.

It is also beautiful how it was the super shadowy coder magic money at the beginning, then a way to order mushrooms/drugs from the internet, retail manias… This is the first asset class in history where the common Joe got ahead of the fuckers. To date, only a select group of billionaires and a limited number of institutions have embraced Bitcoin. The introduction of Bitcoin ETFs, despite being only four months old, has already set records as the fastest-growing ETFs in history.

The Bitcoin allocation.

I have stated this in my many previous pieces, but here we go again.

Typical family 2-kids, working your 9-5 slave work, +20y mortgage.

1-5%.

If you have credit card debt or other debt, cut them first before “saving” in Bitcoin.

The goal is to have financial stability. Work with what you have, and in your capabilities.

Your financial capabilities are at the level of a monkey. Don’t play the monkey games of selling your house or taking out a bigger mortgage to buy Bitcoin or whatever asset (Tesla stock was also popular); you see this behavior near the top always. Have you heard many stories that they came out as winners?

Monkeys are always excited when they find new ideas. Sure, Tesla has a fighting chance to be the biggest company on earth, and Bitcoin has the potential to be the best savings technology, but it takes decades, not in the next 1-2 years…

Being a monkey is also a blessing. The strategy of a monkey is to DCA a little bit here and there, mainly to ETFs and a little bit of Bitcoin 1-5%. You win with this strategy in the long run.

Of course recommended to study/learn more constantly. The sad truth is that nowadays, it doesn’t require much to get ahead.

Gold is also wonderful as a wealth preservation tool. Yes, it is boring, and yes, it won’t have massive gains (also no massive downside). Preserve your wealth. If I were just about to retire, I would have a bigger allocation to gold than Bitcoin. It is pretty hot now; some Tesla analysts have turned on my feed to gold bugs and commodity experts and just crossed 2300 for the first time. Usually first signs of exhaustion.

For all the goldbugs I would also recommend 1-5% allocation, why not? How is gold superior to Bitcoin?

Conclusion

Over the long haul, Bitcoin is poised to be the ultimate hedge against a myriad of financial uncertainties, though it's currently in the speculative asset stage. This speculation phase is crucial — the more intense it is, the better for filtering out the fraudulent from the genuine (think FTX, Luna). True value has a way of emerging victorious over time. It's a lengthy process to separete the value from the shit, meaning we should brace for continued volatility.

I wanted to believe it was the ultimate hedge against Inflation (see 2022) and systemic risk (Bank crisis in early 2023), but maybe it was more liquidity and hopes of Fed easing (all risk assets started to rip). I want to believe it is the world's best savings technology, but it isn’t yet. Those who have some wealth can speculate that it will become the strongest one day.

Bitcoin has a chance to eat from all other stores of value.

Currently: Gold > Dollars > Bitcoin

Gold will do good what is to come, and Bitcoin will excel. FIAT currencies continue to grumble.

Gold is gold can it absorb more? Dollar is Dollar can it absorb more? Bitcoin has the potential to absorb from every other asset class (Gold, Bonds, real estate).

It has also worked as a hedge against everything if your holding period is +5 years, with constantly buying the capitulation wicks, or be it even in the tops. Can 99% of the population do this? No.

Passion for holding and preserving value will ultimately win and change the whole civilization for the better. Preserving value is the complete opposite of the horrors of the debt-based FIAT Ponzi paradigm.

This is the winning path, people preserving value and not consuming shit. Sorry, but this will take decades again…

The journey of holding and preserving value is long, but history will look back on it as the pivot that changed everything - for the better.

sources:

https://x.com/BTC_Archive/status/1775516315270148346?s=20

https://www.visualcapitalist.com/bitcoin-returns-vs-major-asset-classes/

https://www.zerohedge.com/markets/gold-vs-bitcoin-winner

https://en.wikipedia.org/wiki/2023_United_States_banking_crisis

https://www.lynalden.com/bitcoin-network-health/