Home Ownership, Renting, and Wealth Generation

A Different Approach: Introducing the Prudent Saver Model - future might require a shift in mindset.

Is the traditional route to wealth—buying a home and hoping for appreciation—still viable in today's volatile economic climate?

The world is changing fast, and what worked wonderfully in the past might not be successful in the future. Saving for small down payments and taking a mortgage has been the go-to model for generating wealth. Nothing is wrong with this; it should be the go-to model for saving. The problem is that almost all wealth is currently tied to houses.

People who own homes feel richer because their homes are worth more money. Because they feel richer, they might borrow more money against the value of their homes. They can use that money to buy things they want, invest in stocks or other assets, or buy even more houses. So, while the wealth effect can make people feel richer and encourage them to spend more, it's crucial to understand that it's largely a paper wealth tied up in an asset you need to live in.

The Get Rich Housing Leverage Model

Have you ever considered how homeownership has become a symbol of wealth and success?

The process of buying a house, rolling down the loan, leveraging the debt, and generating riches can be summarized as follows:

Buy a house with a small downpayment.

Make a small monthly payment on the mortgage.

Refinance the mortgage after a few years.

Use the equity from the refinanced mortgage to buy another house.

Repeat steps 3 and 4 as many times as possible.

This model has worked because of the following factors: (The model has been on steroids in Finland, where interest rates were even negative).

Low-interest rates: Interest rates have been historically low for the past 40 years. This has allowed people to borrow money to buy houses very cheaply. (In Europe and in Finland, interest rates were below 0%)

Appreciation of home prices: Home prices have appreciated significantly over the past 40 years. This has allowed people to make a lot of money by buying and selling houses. (My dad bought our family house for 50k (2000) and sold it for 430k, with plenty of renovations and maintenance. (2019) Normal families can’t afford that now.)

Tax benefits: There are several tax benefits associated with owning a home. These benefits can help to offset the cost of owning a home and make it even more profitable. (Finland used to have huge tax benefits, but not anymore. Taxes are constantly rising, and benefits are cut).

But what happens if the factors that have made this model successful suddenly change?

Risks? The most significant risk is that home prices could decline.

The 2008 Financial crisis was a hard reset for this model. The financial system is still a lot better and more stable than it was back in 2008. The last time house prices declined in Finland was in the 1990’s when the soviet union collapsed.

How prepared are we for a potential downturn in the housing market?

The Current Economic Climate

Rising interest alone is a new experience for many people, like for my dad. Bough a house always, straight after the army, lived a few years, bought a new bigger, and better location, always get more debt due to lower interest rates, and house values were appreciating - Rude awakenings for many ahead.

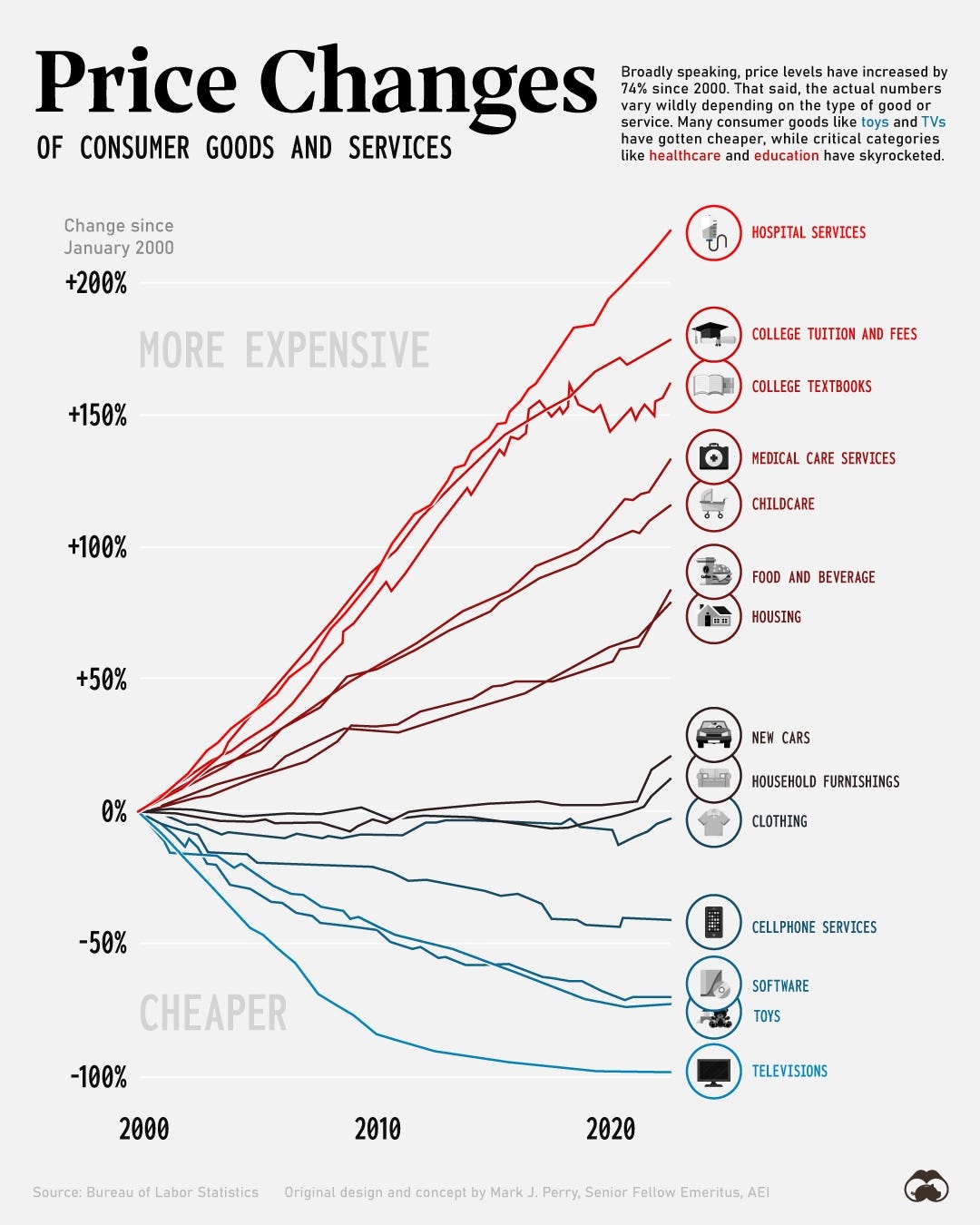

The current economic climate is a big mess, including rising interest rates, inflation, and supply chain disruptions. These factors are putting pressure on consumers and businesses and are likely to impact the “get-rich housing leverage model significantly”.

The treasury yields suggest that investors are betting on a significant slowdown in economic growth and a possible recession. Again bad news for this model:

→ Leads to a decline in home prices? Home affordability is already an all-time low.

→ Recession leads to unemployment. How many can afford mortgage payments?

→ Makes it very difficult to buy more houses and leverage.

Huge squeeze currently on middle-income families, it is more expensive to buy necessities, and housing costs keep rising. We need to live more prudently. The death of consumerism is not a bad thing, in my opinion.

The Prudent Saver Model

But is there a more sustainable approach to wealth generation that doesn't rely so heavily on housing?

Like my father, many in my social circle have chosen to buy houses, reflecting a societal norm that homeownership equals success. I've often been scolded for my decision to rent, with comments such as, "you're just throwing away money on rent." My choice to rent has given me the flexibility that homeownership often restricts. Since 2014, I've been able to adapt my living arrangements to suit my changing needs, moving four times as my family grew from two rooms for my first child, to three rooms for my second, and now a four-room home that perfectly suits our needs without unnecessary excess. This flexibility and the freedom from property upkeep and mortgage stress affirm my belief in my chosen path.

- Owning a house takes a lot of work and maintenance. I also had an “Investment apartment”; it took plenty of time. I got extremely lucky with my tenants, but it still takes a lot of work.

- I have a pretty risky business to run. I have quitted several jobs. If I would rather insert a toothpick in my pee hole than go to work, I choose not to go. Owning a house is not for me, and it is also ok.

At the same time, I want to acknowledge the pride and respect that comes with homeownership. It's a significant accomplishment, and if it suits your lifestyle and financial goals, it's a choice to be proud of. So, to all homeowners, ignore the naysayers and embrace your path. There's more than one way to build wealth and secure a comfortable life, just don’t put 99% of your wealth into the walls.

The prudent saver got royally fucked in the past 40 years, and easy money was everywhere and available to everyone. Pretty crazy to think that if you saved in cash, you would be so bad off compared to the buying house and leverage shenanigans.

The Prudent Saver model is a sound investment strategy that can help you build wealth over time. The key to success with this strategy is to be disciplined with your savings and to invest in a diversified portfolio of assets.

Here are some of the benefits of using the Prudent Saver model:

It is a conservative strategy that minimizes risk.

It is a long-term strategy that can help you build wealth over time.

It is a simple strategy that is easy to follow.

Drawback:

No instant get-rich button - Are the leveraged ones rich or wealthy? They always announce how much their property was valued or how much did they buy it, and now it is their wealth.

It takes a lot longer to reach your financial goals. Why even bother to save when you can take debt and live beyond your means?

You have to rigorously plan your financials, budget everything, avoid debt, and ask 500 times if I need this when purchasing something.

If you are middle class, I feel a bit sorry you have to live now very prudently, and you are forced to budget everything. It will be hard - easy mode is over.

Comparison and Analysis

Prudent saver does not care about home prices and interest rates that much so it could be a more successful strategy for now. Also, prudent savers won’t get margin called.

In 2021, the average mortgage interest rate was 2.96% and the median home sales price was $346,900 (1) (2)

As of 2023, the average mortgage interest rate has risen to 6.96%, and the median home sales price is $436,800. (3) (4)

Commercial real estate prices have started to decline for the first time in over a decade. High vacancy rates in office spaces across the United States are higher than during the 2008 Global Financial Crisis.

So, given these potential outcomes, what strategy seems most appealing to you? It is never too late to start saving.

Different scenarios

These scenarios are oversimplifications, and the outcome depends on various factors. However, they serve as a reminder that the future isn't set in stone. I argue that the “normal” saving wealth by just buying a house and forgetting mode is in jeopardy - What future are you willing to prepare for? EPB Research discusses the current state of the U.S. housing market, which is experiencing its sixth major downturn since the late 1960s. Cycles are normal in every asset class.

Scenario 1: Interest Rates and Treasury Yields Remain High

Homebuying becomes costly, possibly decreasing home prices.

The leverage model struggles with expensive borrowing and less home value appreciation.

The prudent Saver model shines with higher returns on savings. (You get some yield now!)

Scenario 2: Lower Interest Rates & Treasury Yields (Recession)

Borrowing becomes cheaper, potentially reviving the leverage model.

The leverage model is still risky, with possible home price drops and unemployment.

The prudent Saver model faces lower returns on savings and bonds, but diversified investments may still provide decent returns.

Scenario 3: Persistently High Inflation

Savings and earned interest buy less, reducing purchasing power.

The leverage model potentially benefits if home prices rise faster than inflation, but high-interest rates may hike mortgage costs.

The prudent Saver model is challenged by savings instruments not keeping up with inflation. Savers might consider inflation-protected securities or appreciating assets.

Scenario 4: Deflationary Bust (Fed Over-Tightens) - Worst case.

Home values decrease, potentially leaving homeowners underwater and triggering a housing market crash.

The leverage model faces disaster, with refinancing opportunities drying up and leverage restrictions.

The prudent Saver model sees mixed effects: increased cash value but potential job losses and reduced income. Diversification becomes crucial.

Conclusion

Despite the uncertainty and potential difficulties, it's important to remember that things often have a way of working out in the end. Yes, there may be tough times ahead, as there were in Finland in the '90s and during the '08 financial crisis, but we have always found ways to recover. So, in the face of possible high-interest rates, recessions, inflation, or even a deflationary bust, the key is to remain adaptable, diversify our financial strategies, and always strive for sustainable wealth generation.

It won't be easy, but it won't be the end of the world either. There have been crises in the past and there will be in the future - they are part of the economic cycle. We've already seen considerable market volatility, with risk-taking "crypto bros" and SPAC investors feeling the squeeze, and even some banks teetering on the edge. Commercial real estate might be next, and possibly residential homes too.

Could this be the end of a +40-year secular bull market? Only time will tell. But perhaps it's not entirely a bad thing if this turbulence leads us to reassess our consumption habits. The current situation could be a wake-up call to move away from a lifestyle of overconsumption and living beyond our means and shift towards a more prudent and sustainable way of life.

This could be our opportunity to re-establish a financial system that is more robust, more balanced, and ultimately more resilient in the face of future crises. I would love to see policy reforms and a gradual reduction of the money supply, taxes, and the role of the public sector.

Future generations would be far better off. Fiscal discipline is required. Is it time to reassess our financial strategies and attitudes toward wealth?

Hard money folks: Moisturized, zero counter-parties, zero debasements, flourishing.

Sources and good reads:

https://twitter.com/enur72/status/1660161263303811072?s=20

https://twitter.com/stackhodler/status/1660573934348124167?s=20