Hard Money, Hard Truths - Beyond the price

On a risk-adjusted basis, this is probably the best time to get into Bitcoin ever.

Not financial advice, pure comedy, and for fun. Picotop ramblings, sell in May go away…

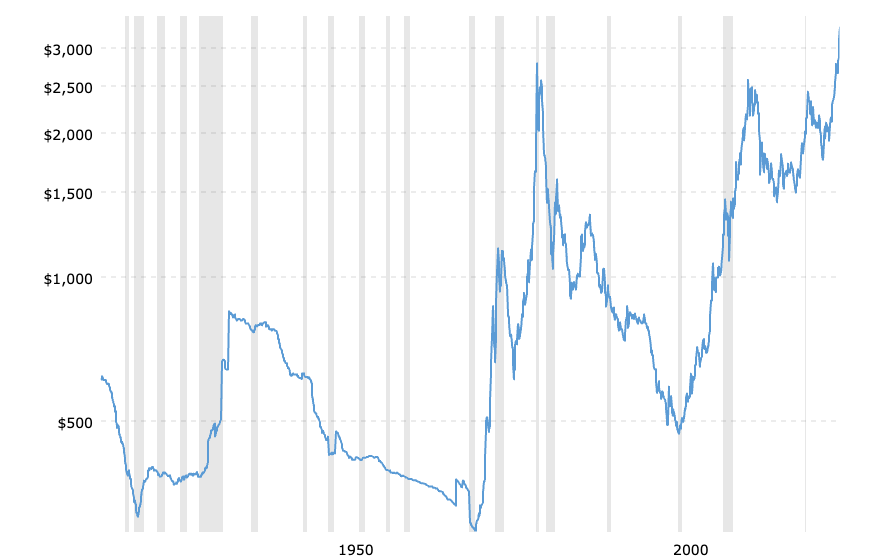

Gold rose over 20 times from 1971 to the peak in 1979. The top was “The death of equities. " Today, history rhymes: the dollar is losing global trust, Trump's tariffs echo past protectionism, wars reshape geopolitics, and inflation resurfaces.

At barely 7% of gold’s market cap, Bitcoin stands poised not just to mirror history, but to rewrite it, fueling the next great financial revolution.

“The statute was fine for the 1960s, but unfortunately we’re not living under those same economic conditions,” says Alaska’s deputy treasury commissioner, Peter Bushre. “We’re living under double-digit inflation, huge balance-of-trade deficits, and a serious energy problem. The current action of both the bond market and equity market bear me out.”

Parallel Today

We have an extremely messy decade on going and a lot of similarities to the 1970s?

Inflation peaked above 9% in 2022

Institutional Milestones: Bitcoin's institutionalization via BlackRock's ETF approval in 2024 parallels gold’s institutional adoption by introducing COMEX gold futures in 1974.

Market Environment: Both periods featured geopolitical tensions and protectionist economic policies. Today's trade disputes and supply chain disruptions mirror the trade wars and oil shocks of the late 1960s and early 1970s.

Market Size Comparison: Bitcoin’s market cap ($1.6 trillion) remains just 7% of gold's ($22 trillion)

Gold YTD + 23.47% (From Trump winning elections + 18.35%) (November 5.11.2024, May 4th 2025)

Bitcoin YTD 2.2% (From Trump winning elections + 38.73 %) (November 5.11.2024, May 4th 2025)

S&P 500 YTD -3,67% (From Trump winning elections ‑1.66 %) (November 5.11.2024, May 4th 2025)

Nasdaq 100 YTD -4,82% (From Trump winning elections ‑0.62 %) (November 5.11.2024, May 4th 2025)

The scorecard does not lie. Soundmoney is winning. Those owning hard assets will preserve wealth; those clinging to paper might face devastating repricing. Risk happens always fast; you either own hard assets or you don't.

What Fuels Revolution

The 1970s saw gold ascend as a physical rebuttal to fiat’s fragility. Today, Bitcoin detonates a phoenix-like rebirth of money itself, not as a politicized tool, but as mathematically enforced law. Trade wars, hyperinflationary policy, and institutional decay are not echoes of the past; they are symptoms of a dying system. Bitcoin’s “ugly contraption” is its unforgeable scarcity, censorship-resistant rails, and apolitical architecture, which renders gold’s analog limitations obsolete. This is no bubble. Bitcoin is the apex predator eating FIAT. Programmable, immutable, and unyielding to state coercion, it transforms money from a weapon of control into a property right of the people. Gold whispered rebellion; Bitcoin executes it. The cycle closes. Fiat dies - Sound money wins.

Are the world and people ready for Austerity?

Sound money demands honest pricing. Subsidies shrivel, zombie corporates evaporate, and speculation with easy leverage blows up. Sound money rewires incentives, savers again beating speculators.

It will be extremely hard.

Decades of monetary distortion created false prosperity. Do you see prosperity around you? Is it in the room with us? Everything is just rotting.

Sound money forces honesty - malinvestments must be liquidated, savings must precede spending, and the government and the financial sector shrink to their proper roles. The bitter medicine of sound money will feel like poison to a system addicted to stimulus. But what awaits us if we refuse the cure?

The Renaissance Beyond the Reset

The middle class rebuilds through hard work and savings rather than borrowing and living on debt.

Capital naturally flows to productive use rather than pure speculation.

Entrepreneurship is based on genuine value creation rather than financial engineering.

Time preferences lengthen.

True price discovery returns to markets (moral hazard dies).

Innovation shifts from financial products to technological advancement.

The Price of Freedom

The question isn't whether sound money returns, but whether you're prepared for it. Freedom carries responsibility. Are you ready to live in a world where actions have consequences, where time has value, and where truth can no longer be printed away?

Bitcoin is not a cheat code to early retirement. Bitcoin is only the freedom to build honest prosperity through personal sovereignty.

No matter Bitcoin's market movements, its core value proposition remains unchanged.

Sources and good reads:

https://www.goodreads.com/book/show/227804284-the-big-print

The Big Print: What Happened To America And How Sound Money Will Fix It

Lawrence Lepard

Exceeded my expectations, always liked this dudes interviews, etc, but I thought this was just another Bitcoin book… Good read, good personal stories. Started this book after I started to write this little blog post. I highly recommend this good. This would work as a good primer.

Even Buffet yesterday 3.5.2025

ON CURRENCIES:

"Obviously we wouldn't want to be owning anything that we thought was in a currency that was really going to hell."

"There could be... Things happen in the United States that... make us want to own a lot of other currencies. I suppose if we made some very large investment [in a] European country... there might be a situation where we would do a lot of financing in their currency."

https://www.reuters.com/business/buffetts-quotes-berkshire-meeting-trade-opportunities-united-states-2025-05-03/

https://www.nytimes.com/1979/09/20/archives/europeans-rediscover-gold-but-longtime-holders-fear-price-collapse.html

https://ritholtz.com/1979/08/the-death-of-equities/