Everybody asking the wrong questions...

Why More Seems Never Enough in Today's Economy

We see this suffering everywhere worldwide, trending on X how nothing is enough, and the salary that used to be enough cannot sustain a family now. In Finland, “students” took over universities since the subsidies aren’t enough… Salaries aren’t sufficient, pensions aren’t enough… People are blaming the government, even though we are running record deficits this year and even more next year. It's a similar story everywhere.

Why are we not asking the questions?

Illusion of Prosperity

The wealth of average families is in their houses, creating weird illusions. I bought my first house in 2005, just after the army. This was a small one-room flat, and I sold it in 2019, double the price. I did zero renovations, and it needed huge renovations in the near future (new pipes, facade, etc). The price was 28x my gross salary. The current median income among youth 20-29 is 2500€ (2020), who manage to get work, we have massive youth unemployment at the moment… The current price of a similar apartment is 119 000€. 47.6 x the median income.

My family house was bought on the pennies in a nice neighborhood in the late 90’s and was sold over 3x. On top of that, it was also in need of massive renovations.

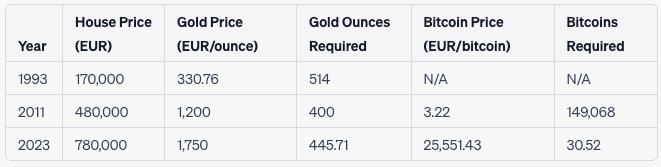

Also, in 1993 (recession here), a 116m2 from a lovely neighborhood close to the city center cost 170k (780k marks back in the day). In 2023, the cheapest is 780k euros, and in 2011, the cheapest was 480k.

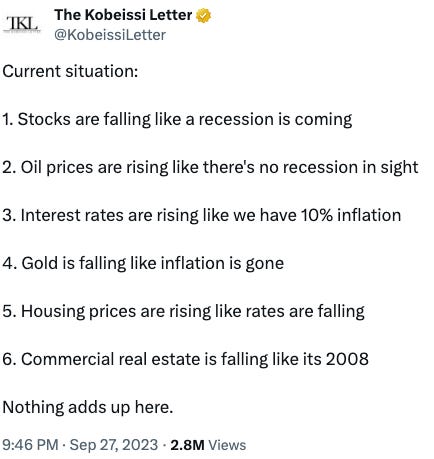

On the other hand, if you bought it in a small city, you can’t even trade it for a sack full of pucks anymore. It is funny how one liter of milk price rises by 2 cents. The outrage is enormous, but when other assets, especially houses, are “what a great investment”, people also say that owning a house is not an investment! Inflation has been rampant in consumer goods over the last few years. Nobody talked about inflation in assets in the previous 15 years? Totally normal that your houses do casual 2x or even 5x in a decade.

Oh, but look, now we are saved! They managed to find an uptick in purchasing power in the summer of 2023, but the damage is already done! And it will get only worse from here.

3 315€ is the median income in Finland (2021).

Has the salaries risen 2x? 5x? No. We are losing our purchasing power constantly. The majority of the statistics are also a way of. How much food do you get with 100€ now? I remember when I was a student, I could live for a fucking month with that. Now it lasts about 3-4 days…

So, house prices have become cheaper in terms of gold since 1993. The use of gold as money began 2622 years ago, proving its enduring value. On the other hand, Bitcoin, a newcomer with just over a decade in existence, has shown an extraordinary leap in purchasing power. From needing a mountain of 149,068 bitcoins to buy a house in 2011, you only need 30.52 in 2023. House prices will go up forever! Maybe in FIAT values, but against hard currencies? They will become cheaper.

FIAT CURRENCIES will continue to debase in the future.

Who's truly paying the price?

The Misdirection of Public Discourse

What problems are our politicians trying to solve? Our top economists are arguing that we need a tiny bit of austerity and cuts to keep the welfare-state alive! What fucking welfare-state Finland is nowadays? Go figure. One economist even asked X how the living quality is worse than in the 80s, even if the GDP per capita has more than doubled.

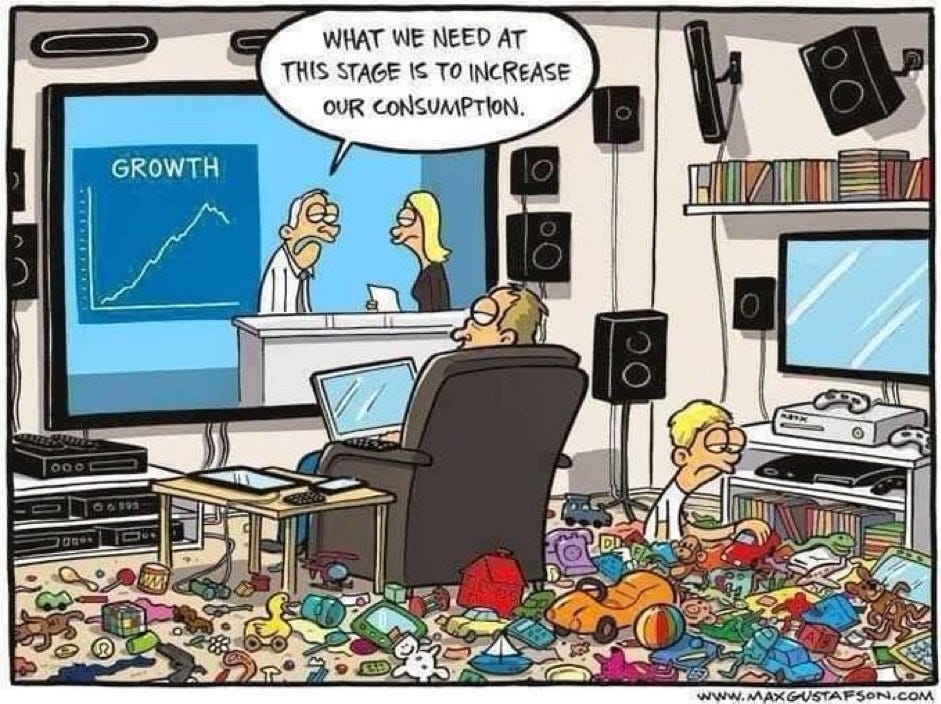

Have you seen any talks about debasement? Or any criticisms that maybe our consumption-based system is somehow flawed? Economists and policymakers aren’t that smart? Did they get anything right in the last ten years? If so, please share. All I see from talking heads:

We need more subsidies

It is the fucking Russians

We need more taxes

It is bad times. The government needs more debt to consume more and save the economy!

Governments don’t need to pay back their debt.

Don’t be scared of government debt.

We need a little bit of austerity - only for the ones who suffer the most. They should consume more!

Our Noble Prize winners and PhDs suggest we reconsider our 2% inflation target. Why not 3%

- At a 3% annual inflation rate over 10 years, €100,000 would lose over €26,000 in purchasing power, dropping to around €74,000. Meanwhile, at a 2% inflation rate, the loss is over €18,000, landing at about €82,000. This seemingly small 1% uptick will fuck up the savers even more. The silent robbery that nobody talks about. I would be in jail if I scammed 26k from some prudent saver.

What can you do?

I wish I had some useful skills and could build something groundbreaking on top of Bitcoin or invent something super useful for humanity. The reality is that I am a university dropout (economics), and have been a hustler, shit talker, and annoying little fucker… I want my kids to be better than me, at least! I want the future to be better! I don’t give a single fuck what happens to me, but I want my offspring to have better opportunities.

This mentality has died completely; it is just about ME; everybody wants to maximize their gains in expense from the future. What kind of future do you see your kids in 30 years if it’s already this shit? Live in some pod and working in diapers in Amazon for 16 hours?

Start learning about economics: To make some sense, what is happening? Majority is clueless. I wonder why they don’t teach any economics. Even the MBAs are clueless. It is just full of bullshit. I don’t know what’s going to happen.

Learning to run some business, side hustle, or whatever to learn the basics—forces you to think more and navigate this mess.

Start at least investing. Again, it forces you to learn more and forces you to think.

Start getting out of the “system.” Acquire real assets. Their value will keep rising, be it gold or bitcoin. Some stocks are also wonderful.

The recession will eventually come; be prepared. Great opportunities will come to acquire assets. Money supply contracting, high interest rates… Takes time. Bad on top of bad…

Live like a student, budget everything, don’t be a consumer.

Don’t become a doomer, things are shitty now, but it always gets better.

Acquire a bit of Bitcoin. Even if you think it is tulip mania or Ponzi. Again, this forces you to learn new things. It is not a get-rich-fast or early retirement asset, you will get rekt in any asset if you go with this mentality.

You will get wiped if you live paycheck to paycheck and don’t own any assets. Saving in FIAT won’t save you.

Hints of people starting to figure out:

Ridiculing economists.

Costco is selling gold bars and they are selling out within a few hours

Hope dies last

It is easy to be just doom and gloom. The disparity between the rich and poor continues to widen as our FIAT currencies continue to crumble. We need to find common ground and not fight with each other over petty things. Focus on making the future better. The enemy is the government and our FIAT system, and our focus should not be misplaced on squabbles amongst ourselves over trivial disagreements.

The pendulum keeps swinging, and we are at the peak of centralization and dependency on government. There lies the sliver of hope – the inevitable swing towards decentralization, where control and autonomy are gradually restored to the common folk. It can’t get any worse, can it?

The path towards decentralization won’t be without its hurdles.

Yes, the road ahead will be challenging; we have lived well beyond our means to a staggering extent, and that debt will inevitably come due. Let's ensure we shoulder this burden ourselves rather than passing it onto our children, shall we?

The advocacy for hard money like gold and Bitcoin becomes more than just a “great escape” - it morphs into a pathway towards self-betterment. Time preference changes - long-term planning over instant gratification. It is hard I lived most of my life on autopilot, drowning in debt and consuming meaningless shit.

As more individuals embark on this journey of self-betterment, a ripple effect ensues. People naturally gravitate towards that.

Each step towards embracing hard money and fostering a long-term, sustainable outlook on finance and life plants the seed of hope and change.

Hard money is the blueprint of a future filled with hope, resilience, and unparalleled potential.

Sources and good shit:

https://www.is.fi/asuminen/art-2000000455063.html