Contrarian in the Chaos: A Market Deep Dive

Looking Back: Reflections on Predicting the Unpredictable

Reflecting on my January article, my rally prediction was somewhat right. Now, it's time to shift our gaze toward the future. It's crucial to consider a range of perspectives. Yet, it begs the question - did anyone accurately predict the events of 2023? Do these predictions bring any value? Can anyone credibly forecast what lies ahead? How do we navigate through this wild ride and cut out the noise?

What will happen in 2023? Last chance to get out? Final clown rally to end it all?

The economic data for sure does not look good and something is brewing but will 2023 be so bad? I was sure everything would start to break when the interest rate was above 3%. Surprisingly strong economy? Still, nothing hasn’t broken yet? Will it be in 2023? Yes, it takes time.

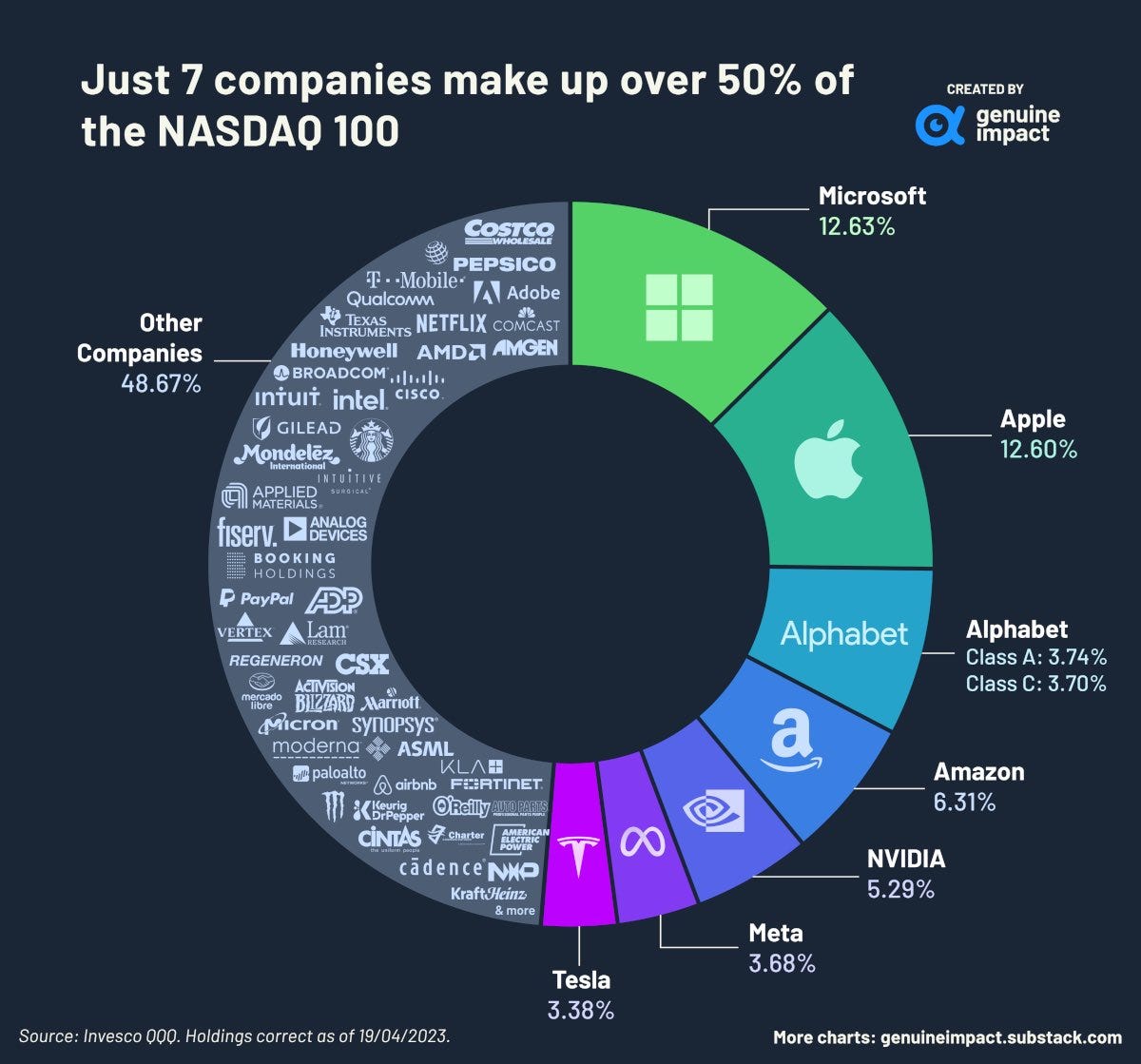

Why did the Nasdaq have the best start of the year in 40 years? AI MANIA. GREED. EVERYBODY BEARISH.

But let's not be fooled by the euphoria; the market is a circus, and we must be prepared for when the music stops. Many are posting their all-time-high portfolios on Twitter. However, such widespread gains can often signal a market peak. If you bought the bottom in late 2022 and early 2023, it might be a good time to take some profits. BUY RED, SELL GREEN.

As my blog name is “Kiiski Unfolding” it’s Ruffe fish, the little fucker who always goes against the current, a contrarian. That’s how I have always been. You did wonderfully after covid if you just went against what the talking heads were saying. “Everything will crash” BUY. Now we need everybody to turn bullish again, and I become the gay bear party ruiner again.

My posts have been quite doomers, but I have emphasized that this is a long-term game. I am not a trader. I have tried paper trading multiple times and always end up 6-7 figures in losses. Finding quality & strong companies and stacking good assets always wins in the long run - No matter what happens this year. Find your little niche and strength in the market and play with that. The biggest advantage of retail investors is: We can stay in the market and hold our bags. We win in the long run if we keep the plan.

This is war. I want to position myself so that I win no matter what.

No leverage

Cash

Have some diversification

My goal is always to grow my asset portfolio. Live like a student. Invest. Stay out of debt. This strategy beats everything in the long run.

How things have played out has been pretty weird, and I believe the weirdness will continue. We've witnessed 'the recession that never came', so what's next? Regardless, I'm prepared for the unexpected. I keep my plan.

In a world where the 'recession that never came' is our reality, and NASDAQ's unpredictable surge is the new normal, we're truly navigating through a financial Wonderland. Chasing narratives and FOMO to tops will get everybody burned in the long run. Don’t also marry any assets.

Looking forward:

Will everything continue to rise? Yes. But will their rise in value? Maybe not. I have been rambling about debasement to death. Nominal values will continue to go up.

The rally will continue; everybody tends to buy green candles more than red ones. We will need everybody to scream that it was the bottom and the new cycle is just beginning. Then it is time to assess the situation again.

Maybe the correction won’t come this year or even for many years, but eventually, it will come. We have too much shit still alive. We need the purge to build a more productive world. I still believe there is a huge capital misallocation - Look around. Does it look like 🤡 ? YES. Plenty of zombie companies, stupid government spending, and even zombie countries are forming (Read my stories on Finland). Stay out of 🤡, low returns with high risks. Seek value.

I keep my eyes on commodities since I strongly believe the policy responses to all this “weirdness” will ultimately be inflationary.

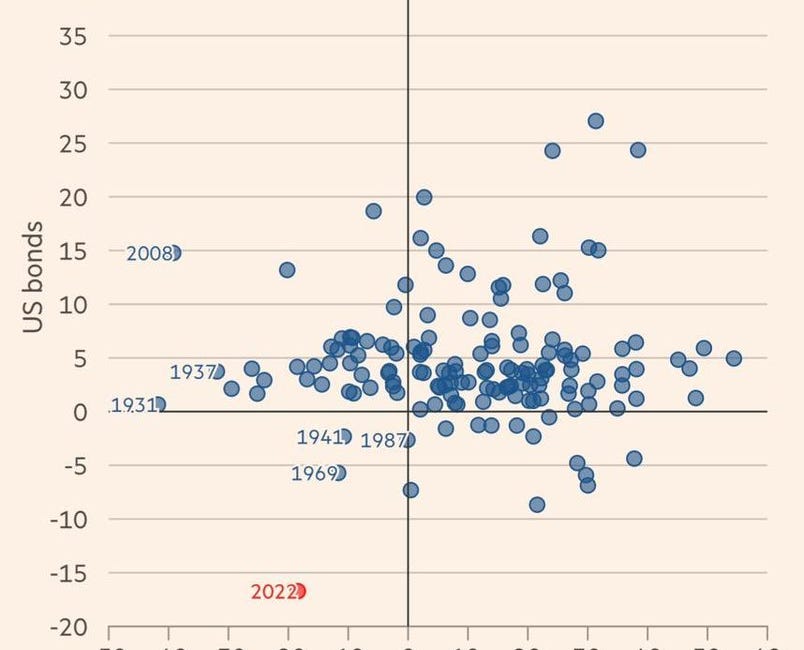

The question you have to ask yourself is, will the same work in the markets that worked from the 1980s?

Or

With interest rates rising, much like during the dot-com bubble, and the Federal Reserve raising rates ten times since March 2022, leading us to a 5% rate as of June 2023, could we be on the cusp of a similar market downturn? Are we navigating a financial landscape that mirrors the frenzy of the dot-com era?

Lots of similarities:

Market Behaviors:

Excessive Speculation: Investors, driven by fear of missing out (FOMO), were excessively optimistic about the potential of dot-com companies. Even businesses with little to no revenue, and no clear path to profitability, saw their stock prices soar after their Initial Public Offerings (IPOs).

Easy Capital: Venture capital was readily available, and many internet companies raised substantial funds despite having unclear business models. A significant number of these dot-com companies spent vast amounts on advertising and promotions to try to "get big fast."

IPO Frenzy: The initial public offerings (IPOs) of internet companies generated massive interest. The promise of high returns led many to invest without due diligence, driving up stock prices.

Outcomes:

Burst of the Bubble: When investors realized that these internet companies were not going to deliver the predicted profits, confidence declined rapidly. This led to a massive sell-off in the market, and the bubble burst. Many companies saw their share prices crash, and numerous dot-coms went bankrupt.

Economic Impact: The dot-com bubble burst led to a mild recession in the early 2000s. Unemployment rates rose as many internet startups folded, and wealth tied up in the stock market vanished.

Transformation of the Tech Industry: Despite the severe crash, the dot-com bubble left a legacy of transforming the business landscape. It spurred infrastructure developments that paved the way for future tech giants.

Lots of lessons to be learned.

Other things to keep an eye on:

China slowdown? From debt to deflation risk?

Europe EUR - Massively overvalued?

UK - Doomloop?

Bitcoin

Everybody is talking and screaming about the new ETF applications. It is awesome for Bitcoin, but how big an impact can it have? Yes, Bitcoin's biggest price driver is scarcity, but these predictions are getting out of hand.

The Market Capitalization of Gold is currently around $12.738 T. Bitcoin is 0.5 T.

GBTC is currently the biggest in the Bitcoin space, with assets under management: 19.04B for July 5, 2023.

When Blackrock ETF comes, will everybody FOMO in? How big will it get? You already have options like Microstrategy stock to get some exposure. The best option is always self-custody.

Bitcoin will grow if the 🤡 continues. The strongest will always win in the long run, and Bitcoin is my beacon of sanity. Bitcoin is an international asset, and the world needs it. Adoption will grow. Don’t marry assets. I question my Bitcoin position every day. I believe it is still vastly undervalued:

Bitcoin's market cap is approximately 3.92% of gold's market cap.

Bitcoin owners of the world's population 1-5% (estimates).

Conclusion

In conclusion, the unpredictability of the market is a reminder of the importance of sound financial strategies.

Making informed decisions

Let's continue to seek value

Stay resilient

In the end, the unpredictability of the market is a reminder that the key to financial success lies not in predicting the future but in having a sound financial strategy that can adapt to any future.

Many will throw the towel to the ring and give up on investing and saving if the deterioration of our purchasing power continues or is squeezed by high-interest rates. More pain to come?

As we forge ahead in this unpredictable market, remember that resilience isn't merely weathering the storm but learning to dance in the rain. Our financial victories won't come from prophesying the market's next move but from sound strategies and steadfast commitment to our financial health. So ask yourself, are you ready for the dance?

Sources and good stuff

https://twitter.com/kouroshshafi/status/1677359822700949505?s=20