Cognitive Dissonance and Bitcoin

Applying Cognitive Dissonance to My Bitcoin Journey

My story

My first encounter with Bitcoin was in 2011 during my bachelor's thesis, where I explored the future of the Yuan and delved into the history of currency systems. Bitcoin came up a few times… I was scared and ashamed that I had fallen too deep now. Have you ever found yourself on a YouTube binge until the algorithm starts feeding you such bizarre content that it snaps you out of your trance? “Ok, enough youtube for today.” That was me back then with Bitcoin. I thought Bitcoin was pure vaporware and tulip mania. “It has no intrinsic value.” I was ashamed even to bring up that I found this Bitcoin thing.

I dismissed Bitcoin every time it came up, disregarding it as something only "stupid" or unconventional people would get involved in. I believed that those who were overly inclined towards entrepreneurship and had lower education were the ones participating in these Ponzi schemes… I even found myself staging an "intervention" for a family friend who had been drawn in… As a well-educated and corporate slave, I was perfect for telling him that these were fucking scams. Stop right now wasting your time and money.

Fast forward to 2018, my good friend started to shill some crypto to me at a party. I just laughed and told him you are in tulip mania. Stop now. He was persistent and even showed me some transactions. We laughed it off and continued to party. I still was bothered about it and started to look up to how this smart guy was on this shit. Is there something here? I started listening to a few podcasts, reading articles, and even buying a bit of that Bitcoin.

In 2019, I found myself in a "doomer mode" where everything seemed dull and valueless. I only owned a few value stocks; all they were doing was stock buybacks… Back then, there was also doom and gloom that everything would collapse. Hurray, covid came and saved us. The collapse I was anticipating came, but it was completely different. This was the final snap for me.

However, the theme of currency wars stuck with me, especially the realization that the only solution proposed back in 2011 was to keep doing what we're doing now. Take more debt, more easy money, more deficits…

Understanding Cognitive Dissonance

Cognitive dissonance, a psychological theory proposed by Leon Festinger in 1957, refers to the discomfort experienced when individuals simultaneously hold contradictory beliefs, values, or attitudes or when their actions contradict their beliefs.

It is like a mental tug-of-war, and how to win it? Deciding which idea they agree with more and focusing on that, often ignoring or downplaying the other conflicting idea.

My journey from skepticism to acceptance of Bitcoin vividly illustrates cognitive dissonance in action.

Changing one's beliefs, values, or attitudes: Step One - Changing Beliefs: Initially, grounded in traditional finance, I dismissed Bitcoin as a scam and a modern "tulip mania."

→ However, as time went on, my exposure to Bitcoin and its growing adoption in the financial world began to challenge my initial beliefs.

Adding new information or beliefs that reduce the dissonance: Step Two - Adding New Information: My friend's persistence piqued my interest in "cryptocurrencies," leading me to delve deeper into Bitcoin.

→ I started listening to podcasts, reading articles, and even buying some Bitcoin. This new information began to shift my perspective.

Changing one's behavior: Step Three - Changing Behavior: The climax of my cognitive dissonance journey arrived in 2019, further intensified by the Covid outbreak in 2020. At this point, I began perceiving the potential for a significant economic correction, further shifting my perspective on traditional financial systems and how “rigged” it is.

→ The theme of currency wars that I explored in my thesis stuck with me, and I saw Bitcoin as a potential solution to the problems inherent in traditional financial systems. This led me to fully embrace Bitcoin, resolving the cognitive dissonance I had experienced for many years.

In the grand scheme of things, it may be that Bitcoin is just one facet of life. Yet, the long-run betterment of ourselves remains the essential key, the ability to grow, challenge ideas, and evolve our thinking. Cognitive dissonance, rather than a setback, is a natural and integral part of this growth journey. My cognitive dissonance journey took 8-9 years, a testament to the challenge of opening our minds to new ideas. It's through these ongoing personal evolutions that we not only adapt but thrive in an ever-changing world.

Bitcoin: A New Paradigm

Bitcoin is more than just a digital currency; it signifies a paradigm shift in our understanding of money. It challenges our conventional belief in money as a tangible, government-backed entity and proposes an alternative - a decentralized, peer-to-peer digital asset. This shift isn't purely technological but philosophical, as it prompts us to reconsider the role of central authorities in dictating money supply and value.

Attributes of Bitcoin include:

First truly global currency

Private, with no government oversight

Operates on digital, rule-based protocols

Constitutes a new form of monetary system

Ultimately, Bitcoin forces us to reimagine economics and monetary policy fundamentals.

Bitcoin can appear daunting, even dangerous, to both "ordinary" individuals and highly educated people accustomed to traditional systems. Bitcoin represents a significant deviation from the known and trusted.

In our familiar banking system, central authorities like governments or central banks regulate the money supply, maintain stability, and provide a sense of security. In stark contrast, Bitcoin operates on a decentralized network, meaning no single entity controls it.

Bitcoin contests the deep-seated belief in the necessity of such control for financial stability and security. Reactions range from dismissive - "LOL it's not backed by anything", "It's just tulip mania" - to perplexed.

Additionally, the technology behind Bitcoin, blockchain, is complex and can be challenging to grasp. Misconceptions such as "Bitcoin is complex, confusing, and risky" or "Quantum computers will destroy it" contribute to cognitive dissonance.

Lastly, Bitcoin, still in its infancy and prone to high volatility, is easily dismissed as a Ponzi scheme or tulip mania, perceived as a financial joke or risk.

The Promise of Bitcoin: A Long-term Vision

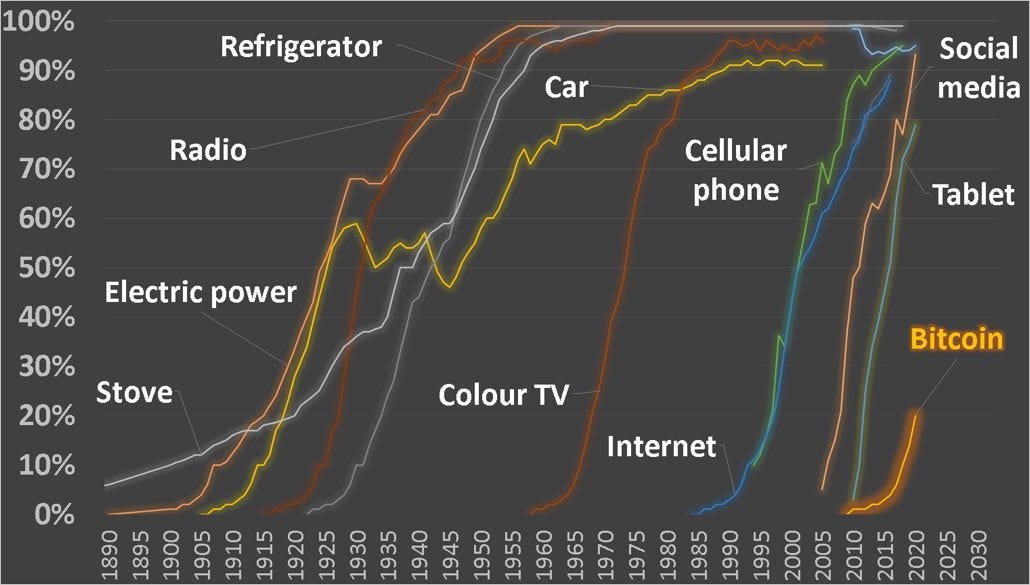

Despite the public perception, Bitcoin is not a get-rich-quick scheme; it's a long-term endeavor that requires patience and a deep understanding of its potential. Predicting the timeline for Bitcoin's growth and price is speculative. Still, looking at the trends and growing adoption, it's reasonable to assume that it might flip gold's market cap within a decade. But even then, it's just the beginning.

Over the next several decades, as Bitcoin matures and more people adopt it, we will likely see even more growth. But it's important to remember that Bitcoin's primary value isn't just its potential for financial gain. It's also about its potential to create a more equitable and transparent financial system. Bitcoin can serve as a "people's currency" and as a neutral monetary system that isn't controlled by any government or financial institution.

More importantly, Bitcoin could serve as a sort of "Cold War" deterrent, keeping our governments honest. With a decentralized currency like Bitcoin, governments must rethink their monetary policies and practices. They would be forced to operate more transparently and accountable, knowing that the people now have an alternative - a monetary system nobody can control.

This is the promise of Bitcoin - not immediate riches, but a long-term vision for a more equitable, transparent, and accountable financial world.

While nobody wishes for the traditional system to fail or crash, leading to a 'Mad Max' scenario, it's about gradually recognizing the potential for Bitcoin to enhance our current monetary framework. Embracing Bitcoin isn't just about exploring a new ideas in finance. It's also about acknowledging its crucial role as a valuable and resilient asset that diversifies and strengthens our investment portfolios. In this way, we're not discarding what we have but fostering innovation, inclusivity, and resilience in our global financial system for a more prosperous and secure future.

Lessons Learned and Advice for Others

When I first discovered Bitcoin, it took me 8-9 years to truly understand it and invest time and effort into learning its intricacies. In the financial turmoil of 2019/2020, I found it hard to see value in most things - but Bitcoin offered a potential solution.

The journey took considerable time and effort, but in hindsight, it was undoubtedly worth it. Everyone has their journey, and mine involved pouring thousands of hours into understanding Bitcoin. The learning process was more enriching than any formal education I received - I equate it to the knowledge gained from 3 MBAs. The best part? I'm just beginning to learn.

Who is easiest to orange pill? - My experience

Entrepreneurs: Entrepreneurs, being natural rebels, are often open to new ideas. Even if they dislike Bitcoin initially, they usually shrug it off with an "Okay, it's pretty cool" and move on. They don't take differing opinions as personal attacks.

Hard-working "Normal" People: This group usually grasps the concept relatively quickly - "So it's something the government can't control? That's a fantastic technology, and easy to use too!" They often have misconceptions from media , thinking Bitcoin is just a scam. However, the most stubborn individuals in this group are incredibly resistant to new ideas.

Highly Educated People: This is the most challenging group to convince, in my experience. Most (99%, in my estimation) of my friends in this category think I've gone off the deep end. Some, like consultants, grasp the concept quickly, viewing Bitcoin as a potential insurance mechanism. However, only a few highly educated individuals I know genuinely "get it". The rest are tough to "orange pill."

The cognitive dissonance is intense. They detest almost every aspect of Bitcoin. They believe that early adopters who profited (druck users and super shadowy coders) were lucky while they earned their wealth through hard work and high education. They are generally well-off, with large mortgages and debt, and are heavily reliant on traditional banking systems - they are, in effect, the product. Why would they take the time to understand this "magic internet money"? Bitcoin solves no problems for them; instead, it could create new ones.

→ Furthermore, this group has a substantial social and professional risk in advocating for or heavily investing in Bitcoin. Supporting Bitcoin might be perceived as naive, risky, or even unethical among their peers and professional circles. The fear of social judgment or professional repercussions intensifies their resistance. The question remains: Are the 99% crazy, or is it the 1% who own Bitcoin?

→ Lastly, there's the comfort factor. The current financial system, despite its flaws, is familiar. Highly educated people often understand this system and know how to navigate it to their advantage. Bitcoin, in contrast, is unknown and unpredictable. It represents a risk that, in their current comfortable position, why risk it and for what?

These individuals have likely not spent the last 8-9 years, tug-of-war, pondering the long-term future of fiat currencies. Additionally, many do not prioritize long-term investing or savings, to begin with.

→ Few that got interested followed the price (only up mode). Panic sold, of course, during the dips or, latest, by the collapse of FTX (Most messages I received here, should I Sell now at 15k?)

→ Events like a banking crisis could serve as a wake-up call. Got a few messages during these bank runs.

Everyone has their own pace and process in understanding and accepting new concepts. The best we can do is share our knowledge, provide support, and allow them to navigate their journey.

Once you embrace the Bitcoin mindset, it can bring about profound personal transformation. It's not just about financial evolution; it's about becoming the best version of yourself. As a Bitcoin adopter, I strive for excellence, integrity, and tenacity.

I firmly believe that the qualities inherent in Bitcoin - transparency, resilience, and independence - are mirrored in those who understand and adopt it. It's not an overnight change but a journey that shapes us in the long term.

In this essence, the long-term adoption of Bitcoin is inevitable; it's not just a currency but a transformative lifestyle that mirrors the resilience and independence of our evolving society.

Conclusion

Reflecting on my journey with Bitcoin, I am reminded that change and understanding take time. The adoption of Bitcoin isn't merely about accepting a new form of currency - It's a lifestyle revolution. This transformation won't happen overnight, and it's okay. We need to be patient, persistent, and open to the paradigm shift that Bitcoin conveys.

In the end, Bitcoin isn't just about challenging the status quo; it's about envisioning a future where financial sovereignty is accessible to all, not just the privileged few. So, whether you're a skeptic, a newbie, or a Bitcoin veteran, remember this: every revolution begins with a single step. And perhaps, that step could be as simple as understanding and embracing Bitcoin.

Much like the enforcers in ice hockey keeping the game clean for star players, Bitcoin serves as a 'financial enforcer,' keeping governments and financial institutions in check and paving the way for a fairer, cleaner, and more resilient economic future for all.

Sources and good reads:

https://coingeek.com/the-art-of-cognitive-dissonance-in-bitcoin/

https://bitcoinmagazine.com/culture/cbdc-bitcoin-dissonance

Orange pilling:

https://twitter.com/WatcherGuru/status/1657756177545961473?s=20

https://saifedean.com/