Bitcoin: Bitcoin, Bitcoin, Bitcoin: Number Go Up or F*uck you money?

How Bitcoin can fail?

Who will buy the bags?

Everybody sees Bitcoin differently. Everybody sees the “value” differently. What is the point of it?

Who will buy the bags? The fucking suits.

What does this do to Bitcoin in the long term?

Will it become some cucked financial asset?

Perhaps a nice piece of history, a novel artifact treasured as a relic. Everything becomes KYC,CBDC. Bitcoin could follow suit. While it remains permissionless in theory, practical constraints will limit it.

A number goes up, and we want the number to go up!

Bitcoiners are again posting their dream cars etc, bullshit. Everybody is so sure the price will go just up.

The next few years are crucial for Bitcoin. What kind of path will it take? What kind of path will our world take?

We will cling to our current currency system as long as possible. Dollar is the best, or do you want Yuan, Rubles, etc? What the fuck you can do with those? (Nothing) Try to buy Chinese stocks? Try to own something as a foreigner in these countries…

How do we keep the system alive?

✅ More subsidies smooth out the cracks as they appear (China, YUAN devaluation, what to do? Why China buys gold? War or devaluation), And the West keeps “subsidizing” everything.

✅ More capital controls and limits to transactions. Why did SVB fail? It wasn't just bad management; it was fear, pure and simple. Fear led to a rush of withdrawals, a classic bank run in the digital age; information moved fast, and the whole X was on fire. So, tighten up the controls, keep the money from moving too freely, and maybe, just maybe, prevent the next panic?

✅ More KYC and AML practices. This is increasing slowly but surely, and nobody talks about it.

✅ Privacy is a crime. (Samuraiwallet)

What could come next?

✅ Interest Rate Manipulations: Politicians and idiots calling for lower rates. We would need responsible fiscal policies and coordination with central banks. Assets go up, and currencies devalue.

✅ Quantitative Easing: New and innovative ways to ease? Assets go up, and currencies devalue.

✅ Debt-Fueled Growth: Historically the backbone of our system, this approach is reaching its limits as the numbers increasingly fail to add up. Innovate new methods to accumulate more debt. It is hard to see how sustainable economic practices would return to the menu. Well, who gives a fuck anyways is it 130% or 1300%

More wars - continue the wars. To keep this up. Huge theater about $60bn of military aid to Ukraine while the US adds 1 trillion in debt every 100 day? Same in Europe…

✅ Digital Currency Initiatives: CBDCs could allow the government to exercise unprecedented economic control. What problems do these solve? Nothing. More power to idiots only.

So, what will this do to Bitcoin? Fuel demand?

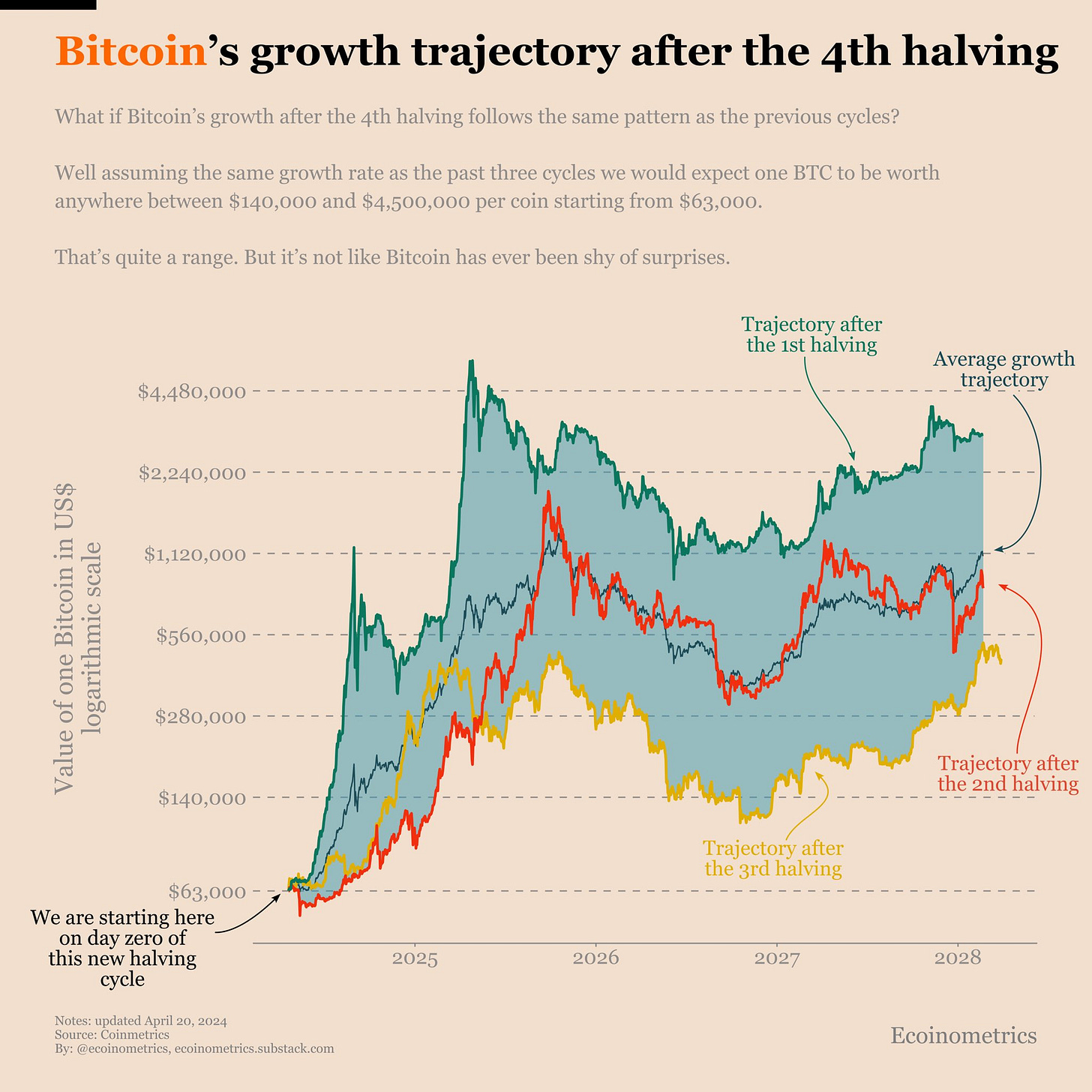

Is there a similar story ahead for Bitcoin? Yes, I think so. Bitcoin is only around 1 trillion, and this fucker will march on like no tomorrow. Bitcoin will do similar to what gold did in the 1970s. Peak price? I don’t know, probably some astronomical dick price. But is even 1 million dollars a lot of money in, let's say, 2028? Supercar makers dream to aim to make customized supercars worth 1 billion…

More and more people will start to understand Bitcoin. Now, they also have the most accessible means to invest in it in ETFs.

"I don't believe we shall ever have good money again before we take the thing out of the hands of the government. Because we cant take them violently out of the hands of government. All we can do is by some sly or round-about way introduce something they can't stop." - F. Hayek

The number goes up. We want the number to go up. Then what?

+30 years of suppressed values as centralization forces tighten their grip, suffocating the very essence of what made Bitcoin special.

→ Regulatory frameworks and institutional influences grow stronger, and decentralized rebel is shackled.

When is the top? Your banker/corporate muppet friends, who always got scared when you talked about Bitcoin, casually tell you what an awesome bet it is and casually own it through ETFs. “I never said I hate Bitcoin.” This happens only when some respected institutions own Bitcoin. Do you seriously think that Blackrock, etc, will settle for a +15% gain and call it quits? No, they aim to make fuck ton of money.

We need the suckers also on this one. The “normies” are always the suckers in everything. It is all they can do: be in the herd. “What a blessing not to think”.

Then Bitcoin will fade away slowly… The financialization of the asset will stop Bitcoin. Centralized mining, centralized trading, centralized custody…. And the suckers love it. Yesterday, news about the Samourai Wallet hit; some even celebrated this.

Bitcoin is a cucked gambling asset, financialised to the teeth, where institutions suck fees like there is no tomorrow and control it. What is the point of it? Why do you want to own it? Speculate to make dollars as our societies continue to decay.

Realistic super bullish case for Bitcoin?

We need to dream. This scenario is less likely I would throw 1-10%. Things change fast nowadays, so anything is possible.

What is the path for Bitcoin to grow as the best neutral money?

✅ Countries start to trade with it to circumvent sanctions. Oil would be perfect, so why not? It would make perfect sense.

✅ Central Banks have started to adopt it. First, some smaller countries, then Switzerland? Switzerland is one of the last bastions of hope “Fortress of Privacy”. You can still buy KYC-free Bitcoin in Europe, thanks to Switzerland. Will they be cucked, too? (Already happening slowly but surely.)

✅ Cultural Shift in Monetary Perception. More individuals have started to question whether our policies make any sense. Embrace Bitcoin as neutral “money”. Will it be enough? Will people start to care, or is it too late? People will win in the end, but how?

✅ Innovation on Bitcoin. Everybody can think whatever about the ordinals, runes, brc20, or whatever, but we need more innovation and experiments on Bitcoin. The more, the better. The usability and scalability are not yet there (Layer-2 solutions?). We also need more privacy enchantments in the long run.

We must dream.

The path for Bitcoin to emerge as the best neutral money involves technological and economic shifts and a fundamental change in public consciousness. This path is ten times harder and ten times slower than the path to a cucked gambling asset.

It will die again but becomes stronger every time and starts to thrive, reshaping our economies and societies in ways we cannot imagine.

Short-term prediction:

The Bitcoin hivemind is still extremely bullish. “It must go up,” and the fuckers are checking sportscars and taking debt and pouring it to Bitcoin in hopes of gigantic supply shock or what the fuck. Sell in May and go away. Volumes will be low during the summer, and the hype will cool off. One year ago, Bitcoin was at 28k. We already had a gigantic rally to over 70k. It needs to cool off, and it’s healthy.

Bitcoin will still be the best bet for what is to come. We will see whether it will become a cucked financial asset or some gritty “gold war” enforcer asset. I have a feeling that after the summer, this fucker will run hard.

What would be bad for Bitcoin?

The debt bubble burst, causing deflation. This is what the world needs, but will we get it? Is the economy booming? Does demand softness/destruction continue?

Prolong the cycle as much as possible. “Number go up” cucked “safe haven” asset?

I just want to stay somewhat free and say fuck you whenever I want.

Sources & good reads:

https://www.epsilontheory.com/in-praise-of-bitcoin/

https://www.justice.gov/usao-sdny/pr/founders-and-ceo-cryptocurrency-mixing-service-arrested-and-charged-money-laundering

https://www.investopedia.com/terms/f/financial-repression.asp

https://x.com/TheBitcoinConf/status/1783270148553560215