Assessing the Risks of Rapid Interest Rate Hikes: A Double-Edged Sword for Nordea

The permanence of net interest income prints is guaranteed to remain unchanged forever

Nordea has become the go-to stock for Finnish people. According to Euroclear, most traded and owned stock, so it is a genuine “people’s stock”, these have recently always ended up badly with Nokia, Fortum… Like sheep to the slaughter.

I have to admit that Bitcoin Twitter is still 100x more delusional and crazier, but this Nordea hype is also getting ridiculous, at least in my Twitter and social circle.

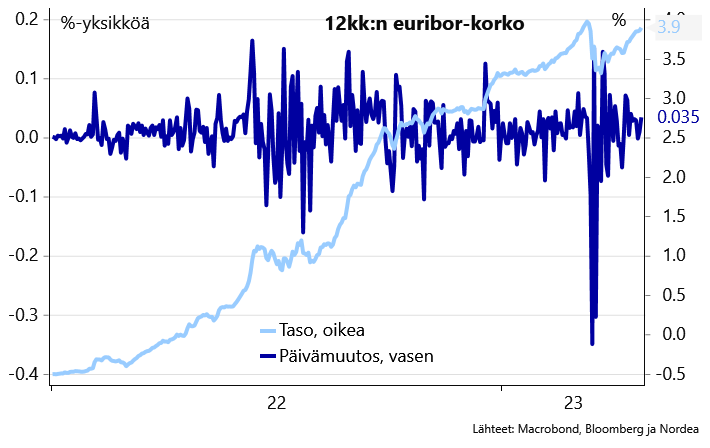

Let’s keep this extremely simple, bankers have a hard time understanding real business, and the same can be said about people who want to own banks. We will focus only on the “net interest income” that everybody screams about. The rate hike cycle is the fastest in history.

Impact on Borrowing and Spending:

Well, what happens when the interest rate rises? You did not have to use any brain cells when the interest rates were negative, but what about now? Will you think twice when it is 4.5%, or do we need more? No growth, no profitability. Remember that you are the product. Few understand this.

Debt Servicing and Defaults:

Again look around you. We have massive amounts of debt. Let’s take more? There will be a time when some cannot service the debt and defaults on it. Again this is bad for profitability. Quality of assets? Can you pay your debt off if you keep taking more and more forever?

Real Estate Market Risks:

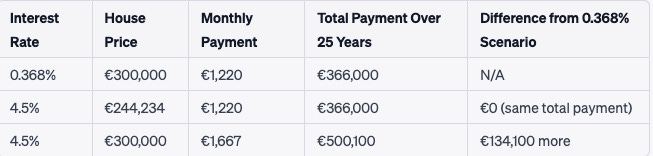

I made this simple tablet that six year old understands. Can you?

What will happen to valuations, affordability, and demand? The permanence of net interest income prints is guaranteed to remain unchanged forever?

Currency Chaos:

Experiment on its own on what will happen to currencies in this clown world when we hike so fast… Hard to see how this helps profitability for Nordea.

Competition and Market Share:

The good thing for Nordea is that there is little to no competition, but what happens if those Apple services would come to Nordics? Yeah, they can’t enter Europe since it is regulated so hard. People are also extremely lazy regarding their money, just let it sit for 0%. When will people wake up? Zombies never wake up, though.

Oh no, I won’t withdraw I love my bank, and Nordea’s brand is so awesome…

Regulatory Changes:

Regulation will continue hard in the future, or what do you think? We are heading to more regulation everywhere, and suddenly let’s regulate banks less since we regulate them so much already? It is goodbye, and we are heading to China’s model.

What effect this has on Nordea's net interest income machine? Again bad.

Conclusion

As thrilling as the rapid interest rate hike might be for Nordea, the ride could get bumpy pretty fast.

Nordea is still good business and could be some “utility” play. Still extremely hard, at least for me, to see any big long-term potential. And what is the utility play even? Do we remain in zombie mode?

What is the bullish case for Nordea in the long term? Innovation? Do you know any intelligent people working in banks? Do you know any smart people who want to work for a bank? Do you know any talented young people wishing to work for a bank? What did they innovate in the last 20 years?

They will become the only bank in Nordics due to regulation? They can only issue the new digital currency with the central bank?

It is ten times easier usually to be bull, but when it comes to EUROPEAN banks, it is 10x easier to be a bear.

I would love to see Finnish bank thrive and Finnish people get extremely wealthy due to this net interest income machine. Still, nothing lasts forever - party mode turns to a hangover eventually.