Amer Sports Elevator Pitch: Arc'teryx Leads the charge China's outdoor consumer Boom

A 90-second pitch on Amer Sports, brands, explosive growth, and hidden risks

Not financial advice, just throwing shit to the wall.

Amer Sports Snapshot

Current Price AS 0.00%↑ : $18.35. 52-Week Range: $10.11 - $18.59

Buy Thesis:

📈 Premium brand portfolio (Arc'teryx, Salomon, Wilson) riding the wave of outdoor consumerism

📈 Exceptional growth in China (60.6% YoY in Q2 2024) while Western peers struggle

📈 DTC expansion driving margins (35.7% of 2023 revenue, up from 29.5% in 2022)

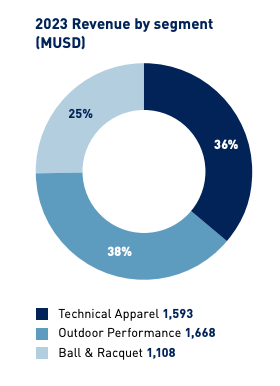

📈 Solid overall revenue growth (23% in 2023 to $4.37B)

📈 Strategic positioning in high-end outdoor market with global expansion potential

🎯 Target Price: $25 based on continued revenue growth and margin expansion.

Risks:

🚩 Persistent net losses ($208.8M in 2023)

🚩 High debt ($1.8B net debt, 2.6x leverage ratio)

🚩 Significant currency exposure (68.5% non-USD revenue)

Key: Amer Sports represents a “hidden” China bet with potentially more safety than pure Chinese stocks. If you believe in the continued growth of outdoor consumerism - especially in key markets like China - Amer Sports could be a compelling addition to your portfolio.

Timing matters! Following China's recent stimulus announcements, the stock has rallied hard (+20%). It's ironic how assets suddenly become "investable" after such rallies. While the “stimulus” doesn't solve China's underlying economic issues, it is not the end of the world either.

Despite near-term volatility, Amer Sports shows strong long-term potential.

Introduction

For many Finns, Amer Sports is more than just a company - it's a piece of our national business heritage. Founded in 1950 as a tobacco company and evolving into a global sporting goods powerhouse, Amer Sports has long been a source of pride for Finland. When Anta Sports and Chip Wilson (Lululemon) acquired the company in a $5.2 billion deal, taking it off the Helsinki stock exchange in 2019, many wondered about its future.

Well, it’s back and stronger than ever.

Is it worth investing, though?

The clothing industry epitomizes peak consumerism, prioritizing brand prestige and technical specifications over practical needs. I don’t see this consumerism mindset ending anytime soon, and I think it will just accelerate. Amer Sports is positioned well to capitalize on this.

Why did they IPO?

To cash out and restructure debt.

Financial jujutsu transformed owner debt into public shares and cash. For retail investors, this is a crucial reminder that IPOs serve existing shareholders.

Focus: Can Amer Sports deliver future returns?

Amer Sports Q2 2024 Snapshot

Revenue: $994M 📈 (+16% YoY, +18% constant currency)

Adjusted Gross Margin: 55.8% 📈 (+200 bps)

Adjusted Operating Margin: 2.9% 📈 (+50 bps)

Adjusted EPS: $0.05 📈 (+129%)

Highlights:

Arc’teryx & Technical Apparel: Exceptional growth driving company performance. Technical Apparel revenue hit $407M 📈 (+34% YoY, +38% constant currency), primarily propelled by Arc’teryx.

Strong Performance in China: Top-tier growth in Greater China significantly boosted overall results.

Raised Guidance:

FY 2024 Revenue Growth: Now projected at 15–17%

Adjusted EPS: Expected at $0.40–$0.44

Key Takeaways:

Financials exceeded expectations across all key metrics

Premium brands like Arc’teryx capturing global market share

Positive outlook with increased full-year guidance

Key Segments - Arc’teryx clear leader

Segment Brands Overview

Arc’teryx is the clear carry here and the main growth engine. Rest are more of a supportive cast. For investors, it is clear that purchasing Amer Sports is, in essence, mainly about buying into the success of Arc'teryx.

Technical Apparel: Arc'teryx The star player

Arc’teryx: Exceptional growth driving company performance.

Peak Performance: Well, having something else in the lineup is nice? Expanding the premium apparel lineup adds value to Amer Sports.

Outdoor Performance: Supporting cast with potential.

Salomon: Notable double-digit growth, especially in footwear.

Atomic: Solid performance in winter sports equipment.

ENVE: High-performance bicycle components enhancing the segment.

Ball & Racquet Sports: A mixed performance - well-known brands.

Wilson: Returned to growth with a strong product pipeline for the second half of 2024.

Louisville Slugger: Contributing to the segment with baseball equipment.

DeMarini: Known for high-quality baseball and softball bats.

Atec: Providing training equipment for baseball and softball.

Betting Amer sports is a bet on whether Arc’teryx can continue its growth. Other segments are more of a nice bonus, offering additional avenues for growth and stability.

Geographic Performance: China strong

China Performance:

Rapid Growth: 60.6% increase in Q2 2024 compared to Q2 2023

Revenue Share: Grew from 8% in 2020 to 19.3% in 2023

Outperforming Peers: Strong growth while many western brands struggle in China

→ They do something in China exceptionally well. Listening to experts how f%ucked the Chinese consumer should be, this performance is exceptional. Are things in China going to worsen or improve from here?

China is Amer Sports' growth engine. Other markets offer some growth and balance, but China is the bet here.

Red Flags:

📉 High debt levels: Net debt of $1.8 billion as of December 31, 2023, with a leverage ratio of 2.6x.

High-interest expenses could limit profitability and financial flexibility.

In every presentation, they acknowledge this and say they will do everything to reduce debt…

📉 Net loss: Despite revenue growth, the company reported a net loss of $208.8 million in 2023. Losses for 3 consecutive years (2021: -$126.3M, 2022: -$252.7M, 2023: -$208.8M)

When will Amer Sports achieve positive net income?

📉 Currency exposure: A significant portion of revenue (68.5% in 2023) was generated in currencies other than USD.

This can turn into a massive shitshow quite fast.

Conclusion

Despite global uncertainties, Amer Sports has shown impressive growth, particularly excelling in the Chinese market, where many Western brands struggle. The pivotal question for investors is: Will the phenomenon of premium outdoor consumerism continue its upward trajectory, especially in key markets like China?

Persistent net losses and high debt levels can't be ignored. The company's journey from a Finnish tobacco firm to a global sports powerhouse is impressive, but can it translate top-line growth into profitability? With Arc'teryx helmed by Lululemon veteran Stuart Haselden and guided by board member Chip Wilson, Amer Sports has a shot at mimicking Lululemons success.

Is Amer Sports a perfect investment? No. But if you believe that consumerism will continue, China rebound and want to own a piece of iconic brands. Amer Sports might be worth the risk.

Sources and further reads:

https://investors.amersports.com/news/financial-news/news-details/2024/Amer-Sports-Reports-Second-Quarter-2024-Financial-Results-Company-Raises-Full-Year-Guidance/default.aspx

Well the stock has run nicely, and the talking heads are buzzing, buy low sell high. NFA